This video explains a lot of the changes in housing prices for normal people. It really is different.

Before I watch this 17 min video, I just want to confirm that this video will explain why the CPI is now borderline irrelevant for 50% of the population. My concern is that it is a video that generally explains why housing and rent are more expensive now (which is accounted for in the CPI).

There have been several posts in this thread doing the math to show why the housing portion of CPI does not accurately account for the real experience of many (most?) renters.

Edit: May be in the portion of this argument that pre-dates this thread.

It’s a tangent, don’t watch. I have no idea about the stats. The video is about corporations finding ways to squeeze more money out of regular people in housing.

Yeah until the YIMBYs take over and there’s more housing supply certain areas will struggle

I think you are making an extraordinary claim that the CPI is now irrelevant as a measure of the general price level for ~50% of the population. The level of time and expertise that would be required to back up this claim is way beyond your scope.

I don’t have any issue with the concept that you are raising, but it’s obnoxious to just dismiss anyone citing the CPI because you think that you have demonstrated anything.

The Zillow Observed Rent Index deviated widely from official government measures during the last few years after running alongside them for the previous five years since its inception.

Unless something has changed, the official Owner’s Equivalent Rent metric is calculated from a survey, Zillow is pulling from actual rental prices on the site. So while it’s unofficial, I think the actual rental listings are a much better indicator of changes in actual rent prices than asking homeowners what they think their home would rent for.

To me that claim is just common sense, and doesn’t require any expertise or time to accept as likely to be true. I think it’s also common sense that in a situation where inflation in rent is high, it’s probably impossible to have one measure of inflation that captures reality for both existing homeowners and renters/potential future homeowners. One side has a fixed cost, the other side has a rapidly increasing variable cost that makes up a huge chunk of their monthly spend.

- Zillow is the same as the cpi measures only when it’s flat.

- Zillow shows significantly less inflation since November 2022 than cpi

- Zillow doesn’t go back very far, making it impossible to compare other periods

- Zillow is so good at figuring out the market that they lost 880m flipping houses during a housing price boom

- You’ve presented no work to say how much these changes would change the cpi measure of inflation

This is not particularly good evidence, it just fits with what you already think

@CaffeineNeeded please stop trying to engage me on this subject unless/until you do this. Otherwise I’m not going to respond to your posts because we’re going to go around in circles and it’ll keep getting nasty, and nobody wants that. And this is not an invitation to PM me again to continue arguing.

I’m not using any of those tactics, so we’re good.

You simply do not have a good argument. Why you’ve made this into such a big deal is baffling honestly.

We are likely to have a pullback without any building. And we are also forecasted to have projects for more building.

Institutuonal buyers cant be blocked. They also arent buying the houses but were investing in REITs and were investing just like they do in every class. But it doesnt matter anyway because they wont be buying when rates come down and their money will be far better used in other areas if that were to happen. Its also an overblown % to shift blame to the wrong places. That small % would also be the first to sell to buyers willing to pay once the market shrinks.

If you literally think home prices are going to continue to soar, i can give you some excellent investment vehicles that would literally track the value of homes as opposed to some building reit that just follows the market. But i dont think you should do that…instead just wait.

I think that would probably be conventional wisdom, but I think there is too much money on the sidelines looking for somewhere to go, and I don’t think institutional investors will let entry level housing drop 20-30% without buying it up hand over fist.

I have been following a few homebuilder stocks and some have talked about developing communities of single family homes just to sell the entire thing to large investors to turn into rentals.

Not currently, which is why I don’t see a big pullback. It could be done legislatively in a couple ways.

I’m pretty sure there are REITs buying up houses, regardless there are private equity funds and other large investors doing it.

Why do you think that? I heard on Bloomberg radio the other day that there’s a record $6T in money market funds. I don’t think that all automatically flows into stocks if/when rates drop, and I think a lot is looking to get into the right real estate markets (suburbs of big coastal cities with good prospects for job growth).

[quote=“Formula72, post:376, topic:771, full:true”]

Its also an overblown % to shift blame to the wrong places. That small % would also be the first to sell to buyers willing to pay once the market shrinks.[/quote]

What’s an overblown percentage? The 30% crash or the percentage of homes being bought by investors?

What are those investment vehicles? I’ve gone overweight in my IRAa on housing, getting into MHO and CVCO as value plays and then cycling from MHO to DHI. I’ve also got stocks that are highly correlated, like WSM.

Now, overweight here is only like 10-15% of my portfolio on homebuilders, more with correlation. Seems perfectly fine given that I’m still a renter, though. At least if I get locked out of a house for a while, those stocks are likely booming.

An investment that literally tracks housing prices sounds like an interesting place to put savings for a down payment, though, once we’re in a position to save - hopefully later this year or early next year.

Even CNBC is saying Biden’s message about the economy being great is spot on.

CNBC is basically a cross between financial newsertainment and cheerleading the wealthy, so no shock there. Still, they point out that a lot of people having fixed housing costs was key to the US outperforming other countries. So it stands to reason that those without fixed housing costs wouldn’t be doing so well.

The U.S. economy’s resilience is also a result of its unique debt structures.

U.S. households were more insulated from spikes in global rates because of the 30-year fixed-rate mortgage, which allowed households to lock in extremely low mortgage rates from the early days of the pandemic. That 30-year mortgage rate, which is mostly unique to the U.S. financial system, protected households as rates later heated up.

The US having a higher GDP than other countries and the US economy being broken for a large fraction of the population are not mutually exclusive.

Well, to me the shock is that CNBC is basically somewhere between Mitt Romney and Trump on the political spectrum and they’re making an argument that the Biden economy is actually pretty good rather than just saying nothing or reporting on “the controversy” as right wing outlets would usually do.

I think you’re arguing with a strawman

The argument that the economy sucks right now is a populist argument focused on the conditions of the bottom 50%. Why would CNBC, an economically right wing outlet, argue for improvements for the bottom 50%?

For you maybe… for the country as a whole? Absolutely not.

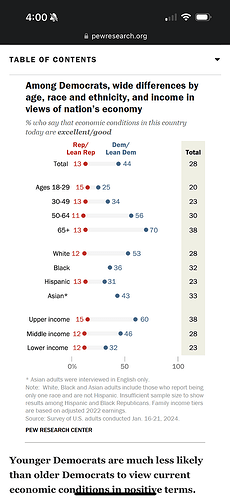

What the nation broken down by political preference and income levels looks like:

Oh look another guy arguing with a strawman. What did I actually say?

They’re making an argument that the Biden economy is actually pretty good rather than just saying nothing or reporting on “the controversy” as right wing outlets would usually do

Second, your argument might be about conditions for the bottom 50% but Trump’s attack on Biden’s economy is different.

We are a nation whose economy is collapsing into a cesspool of ruin, whose supply chain is broken, whose stores are not stocked, whose deliveries are not coming

Looking at things which measure production (like GDP) makes perfect sense in the context of refuting arguments about broken supply chains, empty shelves, and missed deliveries