I’d never heard of ICS before but do know that you can’t get more than $250k insured at one bank unless you have different dependents on the account. Reading your link I guess maybe that works, although I don’t know, I wouldn’t want to gamble on it. Unless the FDIC itself says a scheme like that is fine, in which case, fine.

Lol, rich people, undefeated, always.

Sounds like a good sign…. For John McCain

Sounds like a not awful solution. They’re extending loans to all banks that need liquidity, and they’re backstopping all depositors but funding it with an assessment on all banks.

Of course, that last part probably won’t happen and then the taxpayer will pay, and then I’ll be furious.

Providing $10k to a struggling college grad who took out a predatory loan when they were 16 years old and has been paying on that loan for 15 years only to see the principal increase beyond the original loan?

![]()

Providing billions to backstop billionaires who didnt’ bother with the most basic of due diligence when depositing their money to prevent them from losing 10-15 percent of their money (but they’d still be billionaires)?

![]()

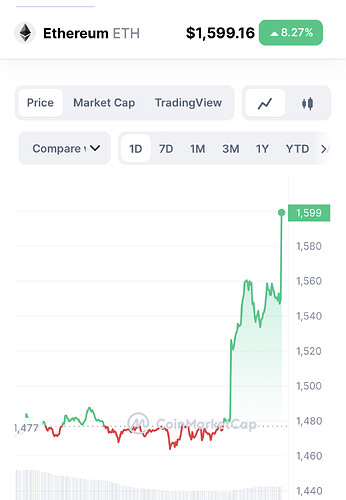

Goddammit buying some crypto was the obv play here in hindsight they were never going to let this fail hard

The problem with a rigged game is that only the ones doing the rigging can win.

Nah I would have been like one of those scavenger fish that swim with a shark

This is a pretty big bank, $110 billion

Also

Before people even had a chance to run it, lol. True O/U on banks that would have gone under this week without deposit guarantee was probably closer to 10 than 2.

Imagine a world where banks were better regulated so the government didn’t have to give them emergency lending every 10-15 years. Oh well, never gonna happen!

These upper mid sized banks had tighter regulations until Rs and some Ds loosened them in 2018. Don’t know if those regulations would have prevented this for sure but should make it gospel that they would have.

One of the key changes was not stress testing banks under, iirc, $250B? SVB came in right under that. Signature looks way smaller than SVB so I’m sure they were well under it.

Seems like that alone could have prevented this.

They got exempted from stress tests, which is looking like a pretty terrible move.

I’m not seeing anything about why Signature Bank failed, though it may have something to do with having $30 billion of Crapto deposits.

Too Big To Fail wins again!

SVB $200 billion and Signature $100 billion. Under the thresholds for stricter regulations but big enough to make a mess when they went under. Educated guess that stricter pre-2018 regulations would have prevented them both from failing. Those regulations were all about maintaining liquidity to survive bank runs.

Meanwhile, Trump blaming Biden for this.

![]()

Wait so what exactly happened in between here? 5 hours ago:

Now, well, obviously things are different

edit: or does she think guaranteeing deposits isn’t a “bailout”?