Yeah, this. How much is Tesla worth again? A whole shitload of idiots means that other idiots don’t make big mistakes relative to other idiots, and it may also protect idiots for a really long amount of time. But that isn’t the same thing as efficient or accurate pricing.

I’m convinced that most of my edge, if I even have one, Is just not being exposed to anything really stupid.

Yes the prices are set by supply and demand. But there is no full stop. Rather, the prices are set by supply and demand AND this determines the most efficient price possible.

No it doesn’t. Here’s how it really works: There are X$ looking for places to be invested on any given day and Y$ in financial products on offer of various types. The size of X has nothing to do with valuation and the size of Y is basically created by RNG (or heavily manipulated by various industry insiders). X tries somewhat to find the best deal on Y it can get, but it basically takes what’s available that day.

I’m not saying there’s no correlation between fair valuation and market prices on any given day, but in my experience prices tend to swing back and forth cyclically to points above and below a fair valuation with the fair valuation level really never being touched except in transition, at great velocity between the substantially overvalued and substantially undervalued levels. This is usually because of fluctuations in X and Y that have very little to do with the actual business the stock represents.

If markets were efficient they would be much less volatile. The price of Coca Cola stock is 50% higher today than it was in 2019 and has gyrated back and forth from 38.30 and 60.13 at one point having both of those prices within a month of each other. That’s a mature megacorporation whose underlying valuation hasn’t shifted more than 5-10% in that same time period. I picked that stock at random my dude. That chart is incompatible with any kind of real market efficiency.

All of that being said valuing stuff is hard and markets are all but designed to cause anyone frequently trading to lose money (outside a few trading strategies that are entirely controlled by institutions with the math phd’s and computers close to the exchanges). Trading as an activity is a generally money losing activity. Carefully buying and holding a group of minimally correlated (you’re actually looking for this hard as you build the portfolio) stocks that were purchased at reasonable prices is something different.

When finance professors say nobody can beat the market the logic goes like this: these wall street professionals who do nothing but work the market all day can’t beat the market so you the investor definitely can’t. The flaw in this thinking is that the wall street guys incentives are absolutely fucked. It’s not their money, there are almost infinite conflicts of interest, and if you look backwards 10 years and picked the theoretically perfect portfolio with hindsight you would have been fired multiple times for having purchased it in the 10 years that followed. All you need is a couple of year run where you underperform the market substantially and your ass is grass. That fact warps the living shit out of the choices those wall street guys can make.

In other news sell side analysts are basically just jim cramer with a much smaller megaphone. Buy side analysts are talking up their own book if they are speaking publicly. Having other people do the work for you is dumb. If you want to do that (and 98%+ of people should) you should just open a vanguard account and stick your money in a retirement date fund.

So the please give an alternative definition of efficient or accurate pricing.

I just looked and today Tesla trades at less than 50 PE ratio and is still > 10x the price it was when people started saying it was wildly overvalued. If it’s been overvalued in recent times, it was also undervalued in the not too distant past when people were still talking about it being overvalued. I think it’s a good example where both the true believers and the critics were wrong but in opposite directions and the price was pretty efficient.

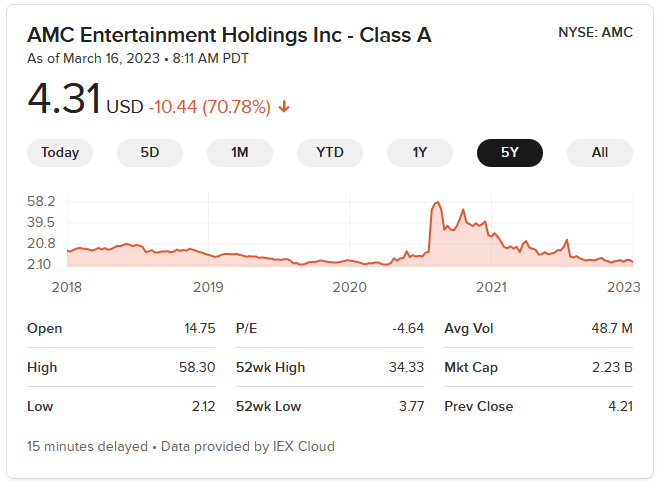

I think some of the recent WSB things with AMC, GameStop, etc. are better examples of potential market inefficiency (and very similar to penny stock pump and dump schemes) but even that is kind of washed at this point. I think hedge funds have figured out how the meme stock game works and can front run those trades and then short as momentum starts to fizzle basically expediting the cycle and capturing most of the gain from the inefficiency.

Edit: I guess people would say it’s not fair to ask “why you don’t buy puts or sell short” since we all know a ‘mispricing’ can last a long time and these things cost money, but if Tesla was mispriced that obviously, a logical move could be to buy all the stocks except that one and get better returns. This is basically what the S&P tried to do by delaying their addition to the S&P 500 index and even going so far as to publicly call them an ‘instrument of speculation’. Of course they had to eventually add them and all the index funds had to buy at a much higher price in December than if they have been added in the spring of that year. Its a good example of experts thinking they’re smarter than the market price (even those in the passive investing ecosystem who should know better) and it basically turning out to not be the case

It this were actually true day trading would be wildly profitable. Just do your discounted cash flow analysis and figure out the true value, then buy when it gets X% below the fair value and sell when it gets X% above fair value. You could even write a software to do the trading.

The fact is, when people actually try to test these sorts of observations without the benefit of hindsight they never work.

There is some truth to this but this would impact the value of all potential investments, stocks, bonds, annuities, savings accounts, etc. in basically the same way. It wouldn’t impact the value of some particular stock differently from the market, though thing like ZIRP can create strange behavior in things like highly risky tech stocks that can still be a rational market response to the availability of cheap money.

Regarding this, even for a mature company there can be vast swings in the future outlook for their business over a couple years as well as changes in things like interest rates or currency exchange rates, that greatly impact the fair value of a share of stock (due to the different return of a competing risk free investment). You can say there’s no way Coke’s production capacity or it’s revenue outlook has changed 50% but that doesn’t mean either the old or new price was inefficient.

From my point of view, this “Carefully buying and holding a group of minimally correlated (you’re actually looking for this hard as you build the portfolio) stocks that were purchased at reasonable prices is something different.” is a statement that requires more proof than your anecdotal, “I beat the S&P and it must be because I was so smart.”

No I fully admit it could be luck. One of the biggest issues with investing halfway well is that you’re going to have a very small list of transactions which means you’re never going to see the long run and actually find out if you had an edge or not.

Thankfully my goal isn’t to beat any index it’s to put my money in places where I probably won’t lose my shirt. My goal is to find boring deeply unsexy stuff that is selling for a price that makes sense and buy that. My whole goal is to reduce volatility as much as possible and invest in a way where my portfolio isn’t overly correlated with the trucking spot market which I’m vastly more exposed to than I could ever be exposed to the overall stock market.

At that goal I’m pretty confident I’ve succeeded. The variance is that I beat the S&P handily doing that. YMMV. I will say though that I’m verifiably good at capitalism separately from my investing results (in fact my logistics track record is infinitely more impressive than my investing track record. There’s a good argument to be made that my investing decisions are just an extension of that with the main mandate behind my portfolio being to keep my powder dry for logistics).

Let’s be clear about KO stock I’m not saying the high price or the low price was inefficient, because I haven’t sat down and done the work (which for a company the size of KO would be substantial) I’m saying one of those prices was definitely inefficient lol. Which one I have no idea but in most cases where I have done the work and there’s been a similar chart the valuation landed somewhere in the middle of the 5 year high and the 5 year low. Go figure.

The less liquid and more information asymmetrical a market is the more likely it is inefficient and can be beaten. Despite what I think of the respective asset classes it is thus a lot more likely that the Crypto bros on the other site had a real and sustained edge in their transactions that anyone trading mid or large cap US stocks. But going back to my original post this is not what I usually see when I talk to smart people who think they can beat the market. They are usually doing some sort of screening and analysis of public information in widely traded stocks

You’re absolutely right that the oversimplified X and Y impact the value of all potential investments. The macro economic environment definitely has a greater impact on the price of any given financial product (absolutely including all types not just stocks) than the underlying substance of that financial product IME.

Yeah when I’m doing my investing it’s basically a hobby and I’m not trying to beat the market in any substantial way. I’m just trying to take my money and put it in something that matches the kind of bet that is best for my personal financial situation. I get a ton of value out of investing in things that aren’t correlated with domestic trucking in the US basically. If I need to borrow against my portfolio I don’t want the value of my collateral to crash at the same time my business needs money.

Please elaborate on how volatile stocks should be if the market is incorporating all known info to project future earnings and discount rates at any given time.

For sure less than 50% in a 5 year time frame for a company as stable as Coke. This is a silly semantic argument you can do better. Sharpen it up some.

Nearly all of that volatility is being driven by changes to the discount rate of KOs earnings. So you either believe that’s not a good valuation model or you believe expected discount rates are actually more stable

I think the multiple the market assigns to companies is about X and Y more than it is about any sane valuation of the business. I think discount rates on most companies are much more stable than the financial markets.

Mostly because of the time period I’ve been playing the game I’ve usually found valuations to be grossly overpriced because low interest rates make 4% implied yields make sense. I don’t think a 25x multiple makes sense for any but the most outrageously safe companies.

I’m not sure, but I’m pretty sure at no point in recent history was north of $30/share an efficient or accurate price for $AMC.

There’s a lot of value to be found in stocks that institutional investors and hedge funds can’t touch because they’re too small. I agree with Warren Buffett on this, mainly because he’s way smarter than I’ll ever be about investing.

Buffett and Munger have also repeatedly said there is more inefficiency in smaller stocks, and that once you’re investing larger sums of money it’s much harder to beat the market. Researchers would be better off tracking a bunch of people investing < $1M or < $10M and seeing whether people could beat the market consistently rather than tracking hedge funds.

Last but not least, as @boredsocial pointed out, the incentives for a lot of Wall Street are perverse and do not align with beating the market over a long horizon.

AMC has lost money four straight years and five of six. I haven’t looked in a while but I’m pretty sure it’s saddled with a lot of debt. The only reason it’s not already out of business is that idiots on Reddit keep pumping capital in.

An efficient market would have AMC priced at/near $0.00. It’s worth whatever someone (Amazon? Apple?) will pay for all the theatres to try something creative to generate value with them, less the existing debt. I’m not sure if that number is more than or less than $0.

They should merge with GME, turn the theatres into e-gaming arenas, and watch Reddit very efficiently take them to the moon.

It sounds like you are basically saying Coca-Cola made/will make $10 odd billion a year over the last several and next several years selling sugar water give or take a few percent adjusting for growth and inflation, so if their valuation is bouncing around a lot then that’s evidence on its face that the market is not rational nor efficient. That, if the market were rational and efficient, it would pick a valuation and stick with it.

Which is… a view, but not one shared by security valuation theory.

Well I already addressed the meme stock thing as an actual inefficiency but a very temporary one