Honestly don’t know the answer to this. Just repeating an unverified stat I heard.

Similarly I also wonder with streaming things how they prognosticate things to decide to have X or X+1 episodes of a show in a season or have 2 new shows vs 8, etc

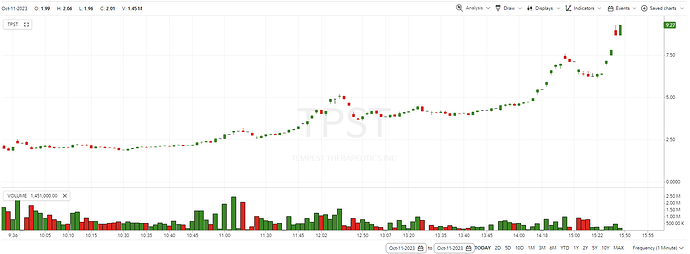

Previous close $0.24 for those wondering. Some biopharma that has a cancer drug that had a good result or something.

r/pennystocks said trading got halted twice today on it

my trading desk has a warning message saying it was delisted but I can’t find any other info to corroborate that

Oh yeah, figures. I jumped on ALXO for the same reason, it’s up like 24% but I’m afraid it’s gonna crater before the weekend. GRT had a bump earlier this week and it’s already back down to where it started.

Facebook ad right now:

Hello everyone, my name is Cathie Wood. As you may have heard, I decided to sell Tesla stock in order to better enter the European market.

Since many fans asked me why I made this decision, it is difficult to respond to them all. Therefore, I decided to create a WhatsApp investing group to explain it all to you!

In this group, I will share the reasons for my decision and reveal my strategy for entering the European market. Join us to discuss the future of investing!

I will share my investment methods with you, and let us start a new investment journey together!

Professional investment advice is provided here, and stock trading information is provided free of charge.

As a senior stock analyst, I will share my professional insights and investment strategies with you to help you achieve greater success in your investment journey.

Next page says:

BUY THESE FOUR STOCKS TO BECOME MILLIONAIRE IN THREE YEARS

I’m like 95% sure it’s fake, but would be hilarious if she’s reduced to hawking stock advice in a WhatsApp group.

that has to be fake

Brag:

My very first option trade, PUT (AAL) OCT 13 23 $13 (100 Shares), which I purchased on 10/6/23, returned a healthy 28.57%, thanks in no small part to AAL waiting until today to graciously bump against their 52-week low, not once but twice. Not too freakin shabby.

Beat:

Because my “exit strategy” dictated it, but mostly because I am a goddamned beta wuss, I exited the position not today (10/13) but on Tuesday (10/10) for a loss of 37.84%.

![]()

Yeah I wouldn’t touch options unless you’re doing it for fun.

I made 3000% overnight on TGT puts last year, and had plenty of -100%s as well on other stuff. I probably came out 10x my money but I only threw a grand at it to start, but I’m done.

Options sellers aren’t there to lose and the volatility is brutal. KO puts were up like 5000% in a day on a 5% move since it’s such a stable stonk.

Volatility is where da money at (apparently)

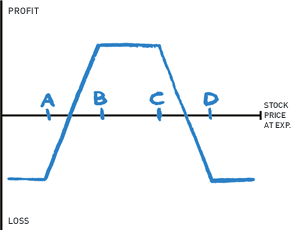

ETA then again not always. Can I interest you in an Iron Condor for your stable stonk sir?

(ignore “loss” focus on “profit” imo)

Anyway, yeah, pretty much for fun. Less boring than staring at the ticker while my money slowly evaporates.

Like today, I flip on NPR on my drive to work, and Marketplace Morning Report tells me that $C just blew past expectations on EPS, revenue, like, everything! Better back up the truck when I get to the office, right?

![]()

Oh FFS as;dljaqweproiasdgl;n

Nothing fucking matters!!! Nothing makes any sense!!!

Like Monday, oil prices mooned because of war in Israel. By Tuesday, prices dropped back down again because everyone realized that, oh yeah, there’s no fucking oil there, duh.

Now today, once again oil prices are mooning. The excuse given? “Israel’s invasion of Gaza is imminent.” ![]()

Google lost $160 billion of market cap today.

Why?

Missed expectations for cloud business.

“Exceeded analysts expectations,” of course, lol Wall Street

Kind of a silly overreaction I’m guessing, but I’ve been too busy this week to keep up with all that. They actually beat on earnings though, and the miss on cloud wasn’t huge. Still grew the cloud business by 22.5% vs 28% last quarter, and the cloud business is only like 2% of their profits.

Levine

Disclosure! I used to sell customized derivatives at Goldman Sachs Group Inc. There are roughly four steps in pricing a complex derivative to show to a client:

- You need a pricing model for that type of derivative. This will be built by quants and will live in the bank’s systems (or on Bloomberg), ready to be applied to particular cases; you pick the model and then fill in the terms of the trade.

- You need to get market data (prices, volatilities, interest rates, etc.) to input into the model. This data will be ingested and will also live on the bank’s systems (or on Bloomberg), ready to be used by the model.

- You might need to adjust the market data, somewhat subjectively, to account for the size and risk and liquidity and terms of your particular trade. If your market data feed says that the implied volatility of a six-month 100-share call option is 35%, but you are selling a five-year option on 10 million shares, you might not want to use 35%.

- Then the model will give you a price, and you will look at it and ask yourself “how much more can I charge the client for this trade?” If the trade is fairly standard and the client is an aggressive hedge fund with its own model who is bidding out the trade to six banks and will call your boss to scream at her if your price is wide, you will quote pretty much what the model says is fair value. If the trade is unique and the client is an assistant treasurer at a sleepy corporate client who is grateful to you for taking him out to an occasional steak dinner, you will add like 2% edge to the model price. This is the most important part of the job.

This really sucks. I’ve got a ton of company stock and we’re getting raked over the coals despite actually doing pretty well from readily available public information

Thing is although cloud has been around for a while it is still is an increasing share of enterprise IT market, and once everyone is locked into AWS and Azure, Google isn’t going to catch up. So maybe there is some analyst/investor sentiment that this is sign they are never going to be a real player in that space