Oh. Fuck.

Yeah but Levine basically said the same thing, so Cramer is probably not wrong this time. Levine said companies may move their money to JP Morgan.

Conbase ngmi?

So what I’m reading is Giannis knows how to manage risk better than a bunch of VCs who want a bailout now?

Yeah, that doesn’t seem so strange, isn’t 250k the FDIC limit? I mean, he probably needs a better accountant, but still there are enough vowels in his name to indicate he doesn’t trust banks very much.

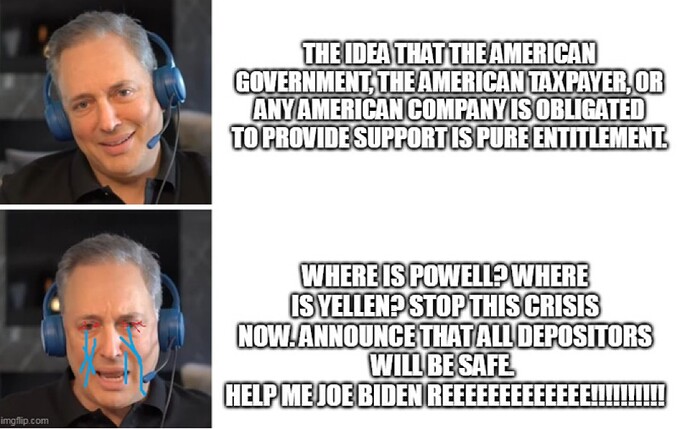

Cramer is so fucking bad at this.

We’re approaching Trump level “there’s always a tweet” territory here:

9 of the 10 stocks are down since that list. Why didn’t we just short the whole fucking list?

I seriously think Jim Cramer’s job is to help facilitate the passing of the bag from the hedge funds and investment banks to the retail investors so that the suckers are holding the bags when the shit hits the fan. Like these Wall Street bros go, “Hey Jim, we’re in a real mess over here. SVB is going to go under. We’re trying to exit our position without totally collapsing the stock. Can you pump it up for those retail shmucks? Yup, we’ll give you a stick.”

I’m not even sure this counts as a conspiracy theory because it’s too plausible.

“While acknowledging that the precise math is not immediately clear, Phillips estimated that the uninsured depositors could face losses of between 10 and 15 percent from the returns on the sales of these assets, which would be difficult for them but not catastrophic for the economy.“

https://www.washingtonpost.com/us-policy/2023/03/11/silicon-valley-bank-bailout-washington/

Um, if we get into Monday with the state of play being that SVB is just going to wind down and uninsured depositors are probably going to lose 10 to 15% of their deposits then hide your children, hide your wife, financial crisis here we come and probably not reversible this time given the state of our politics.

“Not catastrophic for the economy”…. hard to tell if our regulators are that stupid or just powerless and putting their best spin out there.

Confirmed Powell is not that stupid:

So we are just knowingly walking into the abyss?

I mean he’s been trying to trigger a recession for a while now…

The dumbest thing we did in 2008 was the bailouts. This is literally the exact same scenario as the crypto failures that many of you, rightfully so, laughed at the idea of bailing out. But because it’s in $ instead of a cryptocurrency we should bail out wealthy people who were knowingly taking on added risk?

If you want to argue that the FDIC should insure deposits of any amount, go ahead and argue that and get the FDIC rules changed to do so. That comes with a higher insurance assessment that all of the banks will have to pay now. As it is, they knew these deposits were uninsured, didn’t seek out other options to insure the amount over $250k or protect their deposits in any other manner, and put this money into a bank that was higher risk because they were seeking a higher return on their cash that was only possible because of the higher risk involved.

We cannot keep creating these scenarios for the wealthy where they take on added risk and either get richer or they get bailed out at the expense of the average person.

These are the same people always telling the less advantaged people that they need to take personal responsibility and fight for zero regulations, but when those lack of regulations hurt them they cry for a bailout. The same people who likely got millions in PPP loans forgiven while fighting against student loan forgiveness. Fuck them.

I don’t know much about this stuff. But why is it necessarily cataclysmic for whole economy if companies lose 10% of money they had at one specific bank? Or even if a few regional banks fail?

Most people have way way less than 250k in banks so not like mom and pop going to have to run to Bank of America and withdraw 50k cash to hide in basement

And the bank run scenario is bullshit being fed to you by the wealthy as a scare tactic. First of all, most banks don’t have as large of a percentage of their depositors with accounts over $250k as SVB did. SVB specifically courted these customers, offering them better rates than the market, with no business to actually deliver those rates except if we stayed in a zero interest rate environment forever. (Sound familiar to crypto failures that everyone laughed at the idiots involved in?)

But play this out, so everyone with over $250k in a bank account tries to withdraw that money on Monday, and then they do what with it? Stop letting the wealthy spin this story into how catastrophic it will be for the economic environment if we don’t bail them out again. We’re actually killing our economy by continuously bailing out these assholes who keep creating these scenarios.

It’s not, but certain people are incentivized to try to make you think that it is.

The risk taken here was literally investing Treasury bonds. If we are entering a world where you cannot leave your deposits with a financial institution taking such a risk then come open of business on Monday everybody is going to be seeing ghosts and we will all be fucked…. yes, including you.

Or we could just agree to not bail out banks and depositors who are conspiring to commit fraud

This is not an accurate telling of what happened here. SVB courted large customers to their bank by promising better rates than any competitor could, with no corresponding business to deliver those rates like a normal bank would have. You know the same obvious red flag involved in every crypto failure.

So they take in these deposits in large amounts and now need to figure out how to deliver on the rates they claimed they could offer. So they invested heavily in long duration treasuries that could offer these rates. This plan works as long as fed rates stay at zero forever, but this is a giant asymmetric risk that SVB took on as rates could only go up and not down from the current environment they bought in, and if they had to sell these bonds early in a higher rate environment they would experience capital loss.