This gonna be good

I will freely admit your guy can scrap.

I think you’re selling him short. I’m not sure there’s any other Democrat alive today outside of Obama and Jon Stewart who’d be better at going on Fox News. I guess Slick Willy would be pretty good, too, but he can fuck off.

I usually can’t sit through an SNL sketch at all but might have to tune in tonight, so much material they were gifted with. The breathy kitchen karen skit sheesh.

They almost have to open with it.

If you want to wait and see, they basically post the entire show to Youtube the morning after.

I’m starting to believe that Biden is actually an expert campaigner and has mastered the art of dramatically lowering expectations so he can then crush them.

Scarlett Johansson with the Katie Britt cold open. Pretty good

Seems like a good way of talking about the economy!

It’s even more money than you’d think because he doesn’t have to spend any of it defending himself from 91 criminal charges.

ANd he doesn’t have to use it to pay off a woman he raped!

Computer, enhance!

![]()

It’s good news AND those are all pre-SOTU. On the other hand, other polls in that span have him losing so it’s not like every poll has him ahead. Also every one of those polls is a likely electoral college defeat.

But I think he’ll get a decent bump from the SOTU.

I forget where I read it now, but there was a piece earlier this election cycle about how the EC advantage this cycle might not exist or might actually be towards Biden owing to Trump gains in blue states especially among Hispanics and the working class. It’s not inconceivable, as recently as 2012 the EC favored a democratic incumbent.

How different is the CPI over the past four years if we use your preferred weighting adjustments (i.e. adjust shelter up and some other buckets down)?

From what I can see, the changes shelter price index and consumer price index are close. This would be expected as shelter is 40%+ of the index.

Don’t sleep on food for poor families either. A lot of them are spending 20%+ of their budget on food and 60%+ of their budget on housing. Back when I was poor I was making 300 a week and rent was 500 a month, and that was back in the 00’s. It’s gotten much worse since. Like now you make 600 a week but rent is 1500.

I haven’t done the full math but it’s making the shelter item a bigger part of the bucket and switching it to rent inflation, and probably increasing the size of the food and energy portions of the index.

Here’s a graph of observed rents and the shelter portion of CPI. Keep in mind rents lock for a year the vast majority of the time, so the effects of changing rents lag. It looks like rent inflation has slowed enough to pull back the other way, but in order for renters to realize that benefit they need to keep getting wage increases that outpace inflation and they need their local rent inflation to match the trend. It seems very regionalized from what I’ve seen.

It looks like there was around a one year stretch where rent inflation tripled CPI. And then another year or so when it remained higher - and keep in mind the compounding effect. We’re probably talking about rents being around 35% higher now than in Jan 2021, with regular housing inflation being around 20% in that time?

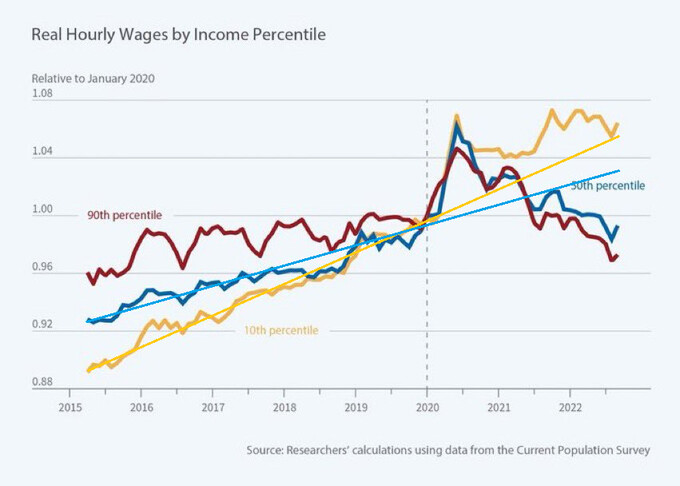

So when I see charts like this one:

I mean this is some ballpark, back of the napkin stuff right, but 1.35 is 12% more than 1.20. So if real wages went up 6% against CPI for the lower class, but the lower class are renters and rent inflation was 12% higher than the housing component of CPI and makes up around half their monthly budget, give or take… and they also got hit harder than the average person on food inflation because at the peak food inflation was worse than CPI, and food inflation was worse on cheaper items, I find it hard to believe that the poor actually made gains in spending power.

Then you have to get into like how did the group with the least power manage to wrangle the supposed biggest gains in real wages? I think the answer is that they got just about enough to keep them even against inflation when it was all said and done, and they started from a subsistence level. So their increases were necessary to keep them alive and working, and that’s how they got them.

Throw in that housing prices went up way more than 20% in some areas. The place I rent is up 33% in that span. So my guess is this effect is going to be in place for a lot of people in their 20s and 30s earning around the 50th percentile but living in HCOL areas and either unable to afford homes or locking in a mortgage at higher prices and higher rates, thus still suffering in the short-term from the worse housing inflation. That’s going to make the picture for them look at lot worse than the picture for the 50th percentile in that chart.

And then it shows the 90th percentile doing worse, but remember this is a chart of hourly wages. The 90th percentile has a net worth around $2M and they earn around $200K. So losing the equivalent of about $8K a year in spending power on their earnings doesn’t matter that much when it’s a trivial portion of their net worth, and oh by the way, what’s their net worth in? The housing prices that are up way more than $8K in that span? The stock market that’s up around 40% in that span? So yeah, they won on the whole deal.

I don’t know about the Zillow metric, but “rent of primary residence” from 01/2021 to 01/2024 has grown at a rate of 6.12%. 19.5% overall.

CPI from 01/2021 to 01/2024 has grown at a rate of 5.64%. 18.0% overall.

I can’t see how that small of a rate difference is upending the conclusion about relative buying power during Biden’s term.