Sounds like? I can tell he’s mad at himself, and he’s finally got someone to take it out on, so I’m just ignoring it.

But seriously, even the person fielding the initial reports at the FBI spends 40 hours a week taking these calls - a big chunk of them about this kind of elder fraud… and she fucking falls for it herself???

I’m sure you didn’t ask her that many details, but of course there’s a big chasm between “falling for it” by calling the phone number in the scam email before realizing it’s a scam, and “falling for it” by feeding hundos into a bitcoin atm before realizing it’s a scam. Hopefully in her case it was closer to the former than the latter…

I’ve been spending today talking to the FBI, the local adult protective services agency, factory resetting every networked device in their house, trying to get them new modem/router/phones/laptop, contacting people who may be next victims, making sure the most valuable accounts are secured and no personal info was changed… So I haven’t gotten to an important thing I need to get done tomorrow.

On the off chance someone has already had to take over their parents finances and knows the answer to this, is there something legal I can do (assuming they cooperate) that lets me have a stamp of approval/veto on any financial transaction over a certain amount, any new accounts, any closed accounts, any personal information changes, etc? Would need this to include home ownership, car ownership, etc. I have no confidence in being able to keep them from being contacted by scammers, answering, and falling for stuff, so I want to put a firewall (me) around anything of value. It seems like power of attorney more or less let’s me move their money/stuff around myself and sign on their behalf, but doesn’t necessarily stop them from moving stuff around themselves?

What you’re talking about is being appointed as a guardian or conservator. It varies from state to state and will involve a court proceeding. If your parents don’t have many assets (and it sounds like they don’t), it may not be worth it. It’s especially difficult if your parents fight you on it.

The better option is just to convince your parents to turn all their financials over to you, maybe set up some kind of trust with alll their assets in the trust and you having control over it as trustee. You could then limit how much money they have access to, require that they get your permission for any withdrawals, etc. Based upon your situation, it doesn’t sound like that is much of a realistic option either because they would need to agree to this. Sorry I don’t have better advice.

Isn’t guardian at litem more a temporary thing the state chooses?

Yeah, I fixed my post. GAL is for a specific case. Guardians and conservators are more general. It varies wildly from state to state.

And power of attorney doesn’t mean you can stop them from doing anything, it just means that you also have authority to sign on their behalf and/or act on their behalf.

I know some folks set up trusts to protect houses/etc from Medicaid if needs nursing home, could setting up a trust voluntarily give someone else “veto power” over things without necessarily having to be a full on guardian? (I really don’t understand trusts so may not even be using the word correctly)

Assuming they don’t fight me on it, can I be a guardian or conservator without a court proceeding? AKA can I do it in the next 36 hours before I leave? I don’t want to leave the East Coast without securing their 401k. It’s not a lot of money grand scheme of things, but it’s enough to sustain them the rest of their lives and allow a little travel, and without that they’re going to come up short every month and it’s going to be a question of whether they’re moving in with us, we’re moving back to the East Coast, or they’re going into a home. So it’s an extremely important amount of money even though it’s not a massive amount.

Would also be nice to block their home equity from Medicaid if/when they need a nursing home. They don’t own it outright but they do have equity.

I haven’t thought it through much but wonder if setting up 2 factor authentication with your phone being the second factor would be good enough to keep them from logging in impulsively?

That’s my break glass emergency option to hold us over for a month if needed.

Update: my father got hacked a few years ago, an e-mail got sent to a bunch of his contacts asking for money for his niece - one of them fell for it and sent $200. He never told me, and didn’t know it meant his e-mail was compromised three years ago. Luckily, his password security was top notch so this only impacted some 30-40 other accounts. At this point I’m shocked he had any money left for the latest scammers.

Knowing nothing about the law of the state your parents are in, I’m still going to say, not a chance.

Thanks… I think the move here is to call a local elder law attorney tomorrow and ask some questions, and then try to plan to make this happen in the near future and do the break glass stuff now?

Put another way, if you were dealing with this and assuming this area of law isn’t near any you’ve practiced in, that’s the type of lawyer to call right?

Yeah, although maybe you can just start with the bank itself? I don’t really have an idea how hard it is to just switch their money over to some ind of trust where you’re the trustee, but maybe you can just do it at the bank without an attorney? Can’t hurt to ask.

Yeah, I can do that with the bank and the retirement account. The bank is a much smaller sum of money, so I want to protect it of course but the retirement account is what I really need to be concerned with.

When whatever financial institution the retirement account is through opens on Monday I would ask them. But yeah, step 2 would be an elder law attorney of some kind. You can call the local bar association and ask for a referral, some of them have hotlines where maybe you can get advice even on the phone for not too much money.

It looks like an Asset Protection Trust is the move for the house - puts me in charge but gives them the exclusive right to live there the rest of their life, and if they end up in a nursing home as long as it’s been 5 years ![]() they can’t get at the house. If I can put the 401k in a similar/the same trust, that’ll work. I’ll talk to an elder law attorney for sure.

they can’t get at the house. If I can put the 401k in a similar/the same trust, that’ll work. I’ll talk to an elder law attorney for sure.

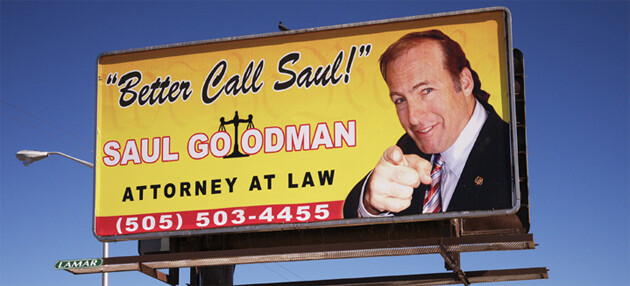

I know an elder law attorney who might also know how to have the scammers murdered.