When has the economy been better than right now? When has the economy been actually good?

I can pretty much guarantee that most young people who are graduating right now have it considerably harder than I did when I graduated in 2001 with regard to very important financial things like student loans and being able to buy a house within a few years.

The US is $ 30 trillion + in debt.

That the economy is doing better than deplorable messaging presents isn’t some slam dunk point.

I wasn’t an adult then, but presumably before the global financial crisis and most of the 90’s. Obviously not the early 2000s in tech specifically. I don’t know which year post-financial crisis to equate the current situation to for the average person, but the few years before COVID were better, probably late Obama was better.

My very broad view is that deregulation under Reagan put us on a path to runaway income inequality, Citizens United threw a match on top of the gasoline (unlimited money → power → money cycle), and the economic indicators seem less and less useful over time. But it’s not linear, of course.

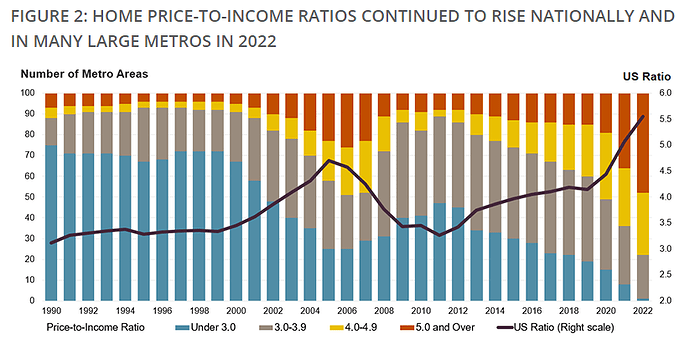

But in the context of this discussion, we’re mostly talking about people who don’t own homes, and it’s going to skew to the under 40 crowd. Here’s a ratio that seems pretty useful in that context:

Up until about 2000, the median income vs median housing price stayed below 3.5. It ran away in the big housing boom before the crash, and then came back down into that ratio briefly. Ever since, it’s been getting worse - and post-COVID it’s been a runaway train.

Now, I graduated in 2008 and quickly found that my degree wasn’t just worthless, it was a hindrance - I had to leave it off my resume to get interviews for the only places hiring (retail, fast food, etc). Needless to say, people who graduated in that time weren’t able to take advantage of the “normal” home price to income ratio then.

I was dumb and went to school for broadcasting, making myself very good at something that never made me more than $13K a year. So my recovery post financial crisis was probably a bit behind a lot of other people and perhaps my circle was the same way, but it felt like people were just starting to get their footing around 2018, 2019, and then… yeah.

Seems like the Millennials who recovered and got on track in time to buy a house in that 2012 to 2021 range are in light years better shape than those who didn’t, and then the childcare costs weigh on some of them on both sides of that equation.

Perhaps the best way to sum this up is that a lot of Millennials and Gen Z feel like they’ve had an economic foot on their throat for their entire adult life, which obviously at the Gen Z end of the spectrum can be pretty short. So at some point, GDP growth doesn’t mean shit for them and they know it. A lot of Millennials are over it after 15+ years of this, and Gen Z has IMO been sharper to the whole thing from a younger age.

As long as the median home is 5.5x the median income and rent is outpacing inflation and we know we’re not going to get taken care of on the Social Security front, never mind inflation and all the stuff about CPI not being a good measurement for the bottom 50%… As long as all that’s going on, a lot of potential Biden voters are going to be pissed, and I don’t blame them. When the “good guys” are leveraging the presence of a fascist dictator to force you to vote for a party that’s done little/nothing to fix any of these problems, it’s pretty easy to be very disillusioned.

Absolutely!

Looking at a house not too far away, a pretty standard “starter” townhouse for a young couple. In 1997, brand new, it was $140K. Median household income then was $37K, so 3.78x. Mortgage rates were around 7%.

It sold in 2017 for $275K, median household income was $61K, so 4.5x but mortgage rates were around 4%.

It’s now worth $450K, median household income is $75K, so 6x, and mortgage rates are around 7% again. In real terms this almost 30 year old house is almost 60% more expensive than it was in 1997 brand new, and in real terms it’s around 80-90% more expensive as it was in vs 2017.

I assume there were points in there around the housing bubble and global financial crisis when it was hard/impossible to buy a house, but when’s the last time a group of college graduates has gone 10 to 15 years into their working careers with roughly half being unable to buy a house?

Oh and, at least around here, my realtor cousin tells me it’s still normal to see his clients make 8-10 offers before one gets accepted, still waiving inspections, competing vs. all cash offers, etc.

And best case scenario this is going to take several years to fix, and as a society we haven’t even started trying yet. The only people trying to address this right now are the people trying to buy up the housing market to turn younger generations into permanent renters.

I know the banks are in better shape than they were in 2007, but thinking about that chart… if housing values were to drop due to a 2007 style meltdown the people who are buying in now might be fucked. They’ll have bought at the inflated prices and too high rates with the intention to refinance, but maybe banks won’t finance a new loan without more principle if the value of the underlying asset has gone down to a point where loan to value is below their threshold.

So my thinking is. Property prices drop, general recession and Fed cuts rates. People who are carrying 2 or 3% mortgages today have a paper loss, but life goes on as long as they can stay employed and make the payments. People carrying a 5-7% mortgage (or ARM) cannot afford their payments due to recession and cannot refinance due to the value of the asset declining. They get foreclosed and the foreclosures on the market causes the housing prices to decline further in a sort of feedback loop.

If you are in the very young Xer or very old Millennial group and had the ability to buy in 2009 it was even better.

The federal government literally gave my then girlfriend and I $8,000 to buy a house.

And there was none of this shit either. We were thinking about an offer on a place, found out someone else made an offer, thought about countering, and said “meh, there’s another place about 500 feet away. Let’s go look at that.”

We took about a week to make an offer, had inspections, 20% down payment. Zero problems.

I’m not saying I haven’t been fucked by this economy, but I am observant enough to see some advantages that I’ve had that are just impossible for people that had my same basic life track, just 10-20 years later.

And then I think about all the boomers who paid their college tuition with two weekends of work at Dairy Queen.

Huge jobs numbers today that beat expectations with real wage growth and extremely low unemployment.

Maybe Biden should say that’s good!

Yeah, this is the point that CN and I have been making! Yes, we agree housing prices are out of control. At the same time, there have been scant few years since 2001 that things have been better than 2022-2024. Sure, housing was more affordable in the depths of the Great Recession, but unemployment in 2012 was at 9%. NINE PERCENT. You really want to argue that “the economy” was much better than based on just the cost of housing? Since 2001, unemployment has been under 5% in 2006-7, 2016-2019, and 2022-2024. Just three times has employment resembled “full.”

I agree that Reagan and his union busting were largely to blame for the current imbalance between capital and labor, but if you want to hang your hat on the inflation crisis of 1979 being the last time the economy was good? We had similarly low unemployment in the late 60s, but I don’t think too many Black people would trade now for then. It’s not that easy to find times when things were objectively better than now even extending to the more distant past.

And yet, Reagan ran on and won with the messaging that the economy was great, despite never achieving unemployment under 5% and while fucking over workers! He didn’t just win, he wafflecrushed 1984. It’s utter lunacy to think that Biden has to put all sorts of provisos and qualifiers on his economic messaging when messaging that the economy is great, even when the economy was clearly worse for workers than it is right now, works really well for electoral prospects.

You could move to Detroit.

Extreme example, but housing isn’t crazy expensive everywhere. So one option available to some, but not all, is to move to an area where housing isn’t as expensive relative to median income.

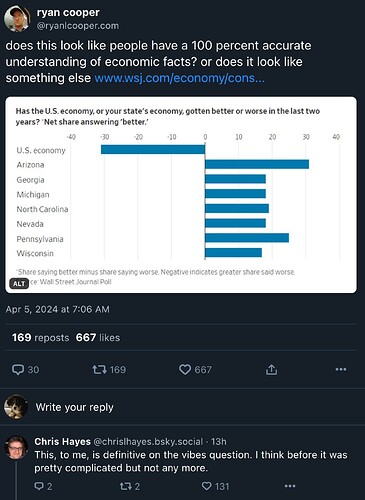

I haven’t read this thread and am unlikely to start, but this seems like an interesting + relevant data point on the topic:

Right, the other thing that stood out to me from one of those screenshots was half the people think their investments and retirement accounts are down over the past year. Sure some people are bad or unlucky at investing but this shows another major disconnect with reality.

I’m not completely following the arguments being made itt, but is anybody seriously disputing that this economic message should be part of the Biden campaign?

Of course it should be part of a broader message about how the economy is not working for all Americans and there’s a lot of work yet to do, etc. but what’s the alternative? Ignore it and cede the entire issue to Trump’s doom and gloom? That can’t be the right answer.

Kinda yeah. I don’t want to oversimplify anyone else’s point of view as no one is writing fully fleshed out positions here.

So my impression is basically that some people want to make a case from a class struggle point of view, as that’s the lens they see the world through. I want to make it very clear that I don’t think that’s necessarily wrong, but I think it’s a limited campaign strategy. I also think it’s possible to appeal to the reasonable people who see the world that way while also saying things are good overall

Yeah this exact thing was discussed extensively.

Basically, how people feel about the national economy has nothing to do with reality and can be heavily shaped by messaging… as proven by the republicans

Another example is the pre-Covid Trump administration. I feel like Don Jr and other surrogates were constantly proclaiming that everything had been moving in the wrong direction under Obama and Trump had single-handedly been able to “turn things around”. Just complete fantasy.

This is a bad thing, not a good thing.

I mean, I would argue the current situation is definitely worse than 2016-2019, and arguably worse than 2014-2015 when the unemployment rate was in the 5.x% range and clearly dropping.

I don’t think calling the current situation great without qualifiers or campaigning on addressing the problems for the working class is a good strategy, that’s my point. I also don’t think telling people, “Hey at least it’s not 1979” or telling black people, “Hey at least it’s not the 60s,” are good strategies. I get that you don’t either, but I don’t think the overall argument tactic that it’s better than XYZ shitty time/situation is a good one.

In 1984 the unemployment rate was 7.2%, off a high of 10.8%. Inflation had dropped from over 13% to below 4%. And that’s before the indicators were all (intentionally) fucked up. Things were getting better and in some cases had already gotten better.

It’s also a very different thing when the economy for workers is bad for like 20 years straight, with small windows of exceptions. People who have been on the wrong side of that are frustrated and angry, and less likely to buy into platitudes.

If I move to Detroit, our household pay cut would more than offset the lower cost of living. For some people that’s an option, but not for many.

I mean I guess what I could do is the thing where high earners on the coasts who can’t afford houses buy a house in a low cost of living area and rent it out, allowing them to invest in real estate and the housing market and more importantly (to me at least) hedge against a future in which they never own a home.

As much as I’m against institutional investors in the housing market and large landlords, I don’t think there’s anything wrong with someone who owns one home and doesn’t live in it, being stuck renting where they live.

Late to the discussion on that one, but that is one crosstab whereas others (screenshots above) show a different narrative. It’s a choose your own adventure kind of situation in that poll.

I know someone with ~95% of his net worth in TSLA, and someone else with ~95% of his net worth in GME/AMC. At least as of a year or so ago.

The S&P is up 27% in the last year. So if you were 70% S&P, 15% AMC, 15% GME, you’re down for the year. Are half of people roughly that stupid?

Or, are they going peak to trough over the last year? Like TSLA is only down 11% in the last year, but it’s down about 45% from its 52-week high. I bet a lot of people who are overweight TSLA are counting from ATH instead of actual 1 year.

The answer I’ve been supporting from the start is to say something like, “We made a great recovery BUT the greedy corporations and wealthy took most of the wins, and the middle class and working class got shafted again, so now the next four years are going to be about righting that wrong by increasing wages, bringing housing costs down, and restoring the American Dream to the middle class and working class, etc, etc.”

Inflation is down to under 4 percent right now (and specifically because of actions Biden took)! Unemployment is down and trending further down!

You have absolutely nothing objective to point at for how it was OK to run on a good economy in 1984 but not 2024.

We’ve been over the ways official inflation doesn’t capture the true situation for the bottom 50% or so because the basket of goods is not representative.

What objective measure of inflation do you prefer?

You and BS have had all sorts of criticisms of any sort of economic stat, but really lacking on actual alternatives.