Seems like the type of thing that never ends well. It could take a decade or more but those firms’ customers will eventually learn the lessons of why those banks have those regulations

Well, that depends. If their customers are wealthy enough, the rest of us will learn for them.

Yeah, definitely seems like one of these things where their “FDIC insurance” might not be real.

I’d be interested to hear whatever you’re willing to share about this, always nice to hear about what scummy companies can get away with in USA#1.

My employer switched our HSA in 2023 from a top HSA provider to some place I’d never heard of. It turns out to be one of these non-bank joints, a Bay Area startup, and I think we literally might be their first customer for their HSA product.

Much like Wealthfront, they have a “banking partner” that holds the cash balance, and an “investment partner” that handles the investments on the backend, and then this company provides the non-regulated front that glues everything together and shuffles your money back and forth without losing it (hopefully!).

Last month, I sold some of my investments in the HSA account and 80% of my account value literally disappeared. I sold the investments, I can see the tx showing the sale, but the balance never hit my account.

- Waited a few days, nothing. Sale is completed, but money is just nowhere, not in any of my balances.

- Try to do “Live Chat”; it’s not actually live, it basically just opens a support ticket. I open one, don’t hear anything for a couple days.

- I call their support line. Nobody answers? Ever? I leave a voicemail.

- Few days later, they reply to the support ticket and say they’re looking into it.

- About a week after that, after some more followups from me, the money just appears.

So for about two weeks, I had a “non-bank” that lost my money, and didn’t offer any phone support. Many of my work colleagues report similar issues with the provider. Not a fun situation to be in.

I realized during this that I’d never had a bank that didn’t provide live phone support? I always figured that was just table stakes for a financial provider.

I mean I was obv 99.x% odds to get made whole, but not 99.999999999% like you would be with a traditional provider, and it required me to keep contacting these guys until it got fixed. If I wasn’t paying attention, would the money have ever come back?

Anyway, I’m basically forced to use this place due to my employer. I’d be wary about voluntarily doing business with any financial provider that is specifically structuring themselves to not be subject to bank regulations. It’s trading a little bit of extra interest for 0.x% additional odds of having a catastrophic issue and x.x% additional odds of having at least a headache at some point.

Well I’m glad you got your money back. That would bother the hell out of me

So for about two weeks, I had a “non-bank” that lost my money, and didn’t offer any phone support. Many of my work colleagues report similar issues with the provider. Not a fun situation to be in.

lol, this is super wack. I guess the value of doing this depends on how large your company is but this is maybe something you should bring up with them as well, like, it’s not a great benefit for this to be the HSA experience they’re pushing onto their employees!

I was obv 99.x% odds to get made whole

I’d be surprised if it was this high

While that sounds terrible, I think thats just something that fucking happens with any non giant bank. I had an account in a regional bank, I requested an ACH from them to a different bank ($5k), money went out, money never came in. I literally went back and forth between the 2 banks 4 times in person and they finally “found” the transfer.

Obviously I was an idiot and when I went to the first bank the first time and they told me to go to the second I should have told them to pound sand as I requested it from you, you figure it out.

Also wealthfront been around since 2008 and everything I read (googled obv) makes it seem like they’re fine. Obv wouldn’t keep more than… 100k there? But seems fine IDK. I guess I could buy the 4.5%ish certificates from my credit union instead? meh

Wealthfront sounds too much like storefront for my tastes.![]()

I think several good options. High yield savings, CDs, quality high high yield dividend stocks…

I think most of the >5+% deals have some fine print like investment size limits (on the high end).

High yield savings, CDs, quality high high yield dividend stocks…

I don’t think dividend stocks belong in this context. There’s a big difference between getting a return on your investment (savings account, CD, bond) and getting a periodic return of your investment. A lot of dividend enthusiasts seem to think a dividend represents some kind of bonus or free money opportunity and it’s just not.

Anyway, I’m basically forced to use this place due to my employer.

I know you can technically use your own HSA and either try to get your employer to route the contributions there instead of this shitty company or if they won’t then make them yourself and write them off on your taxes when the time comes. I’m sure it’s probably a pain in the ass to get this all set up but it might be worth looking into if you continue to have problems.

Luckily I haven’t been in this spot but I have rolled a few over from former employers to one I created on Fidelity which obviously has good investment options and customer service that exists.

Yeah I’m headed to Fidelity now - going to keep this one open for the employer contributions, but move existing funds and future personal contributions to Fidelity.

Of course, all of my co-workers are having trouble with the outbound transfers from this place as well…

Agree but they are a decent medium (2-5 year?) option. And also a better return when value>growth- less risk, like in retirement. My Dad lived 27 years off SS and dividends on a nice estate but by no means large portfolio.

I had some option in my annual work benefits to select a MetLife legal plan. I elected for that last year and used it to hire a lawyer for Will, Living Will, etc. It probably cost around $300 for the year and paid for the lawyer.

Met with the lawyer about getting all this done through the MetLife estate planning coverage which I didn’t even realize I had. Lawyers were quoting some step prices for their basic will/power of attorney/etc package so going to save us like 2k. Lawyer didn’t appear drunk or high on cocaine so seems legit enough

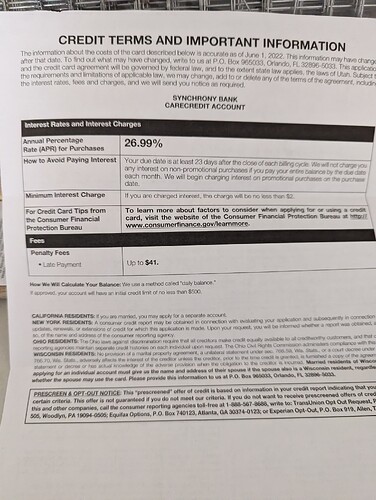

I never really understood how credit cards avoid usury laws. 27 percent has got to be usury, right?

I think they have exemptions in specific states like SD and DE. I know Biden helped the CC industry, and SD did this because who the fuck wants to live there? They needed to be jerb creators!