Wealthfront cash accounts are paying 4.3% atm and consistently keep up with rate changes.

yeah i’ve been disappointed with ally recently. Anyone use CIT bank? They’re offering 4.75%.

Basically what has the best combination of high rate, can easily move money back to my main checking if needed, and fully FDIC insured?

I just dumped my emergency fund into Wealthfront why not. If someone is going to make an account ping me for an affiliate code that will get you and me both +.50% apr

How quick and easy is it to move money between this and a checking account at another bank?

Super easy, barely an inconvenience.

No it hooked up to my account (local credit union) in 2 minutes and now its just pending transfer.

Given what just happened with SVB, are we sure wealthfront is actually FDIC insured? And what is the explanation for how they are able to offer such high rates on savings?

They actually claim much higher levels of fdic insurance than usual:

Typically, banks provide $250K in FDIC insurance. To provide you with $3 million in FDIC insurance, we automatically allocate your money across up to twelve unaffiliated partner banks.

This is part of why I feel a little uneasy about it. They’re claiming they somehow have higher FDIC limits, which makes me wonder if any of it is real.

Does it make you feel more at ease to know their headquarters is in Palo Alto?

The problem with robo advisors is they do direct indexing which is awful to unwind if you need/want to.

What do you mean by that?

fwiw their cash account is just a plain savings account, separate from their roboadvisor service. (I use both so I’m curious what you mean about the direct indexing thing)

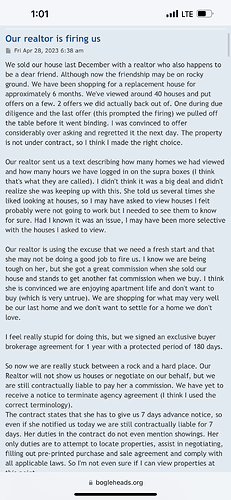

LOL at “She told us several times she liked looking at houses.”

Is it the realtor or the shoppers I should be loling at? 40 showings is above average but it’s not an absurd amount. Every realtor has had picky buyers that take that much time or longer. And the buyers are correct that selling their earlier house should have bought them some goodwill. This realtor is almost certainly still sitting at a great hourly rate for helping these people. The buyers seem a bit oblivious but nothing they’ve done is egregious enough to move my sympathy needle for lolrealtors. Idk the standard for exclusivity agreements but the buyers should be released from theirs immediately.

OK so wealthfront is pretty cool, after some struggle I was able to link it with my credit union, vanguard, fidelity, and my GiantCo’s custom 401k portal even. Only thing we’re missing/doesn’t link through their portal (but there is an entry for it) is, of course

treasury direct. Because… yeah

Wealthfront upping their savings account rate from 4.3 to 4.55. What would cause them to do that?

wow I am really heads down in the fucking job search if I missed that news.

Re: Wealthfront, I know literally zero about them but looked at them a bit after reading the posts above. It seems they are a Fintech “non-bank”… I am currently having a bad experience with a different one of those (long story). Just wanted to drop a couple links in here for those who want some more info.

We’re not regulated like a bank

It probably won’t surprise you to learn that banks are highly regulated. Many of these regulations are intended to keep your money safe, which is a good thing. But unfortunately, some bank regulations can have negative side effects.

Meanwhile, the CFPB (and perhaps other regulatory agencies) is trying to pull these non-banks into their purview, but it seems far from settled.

And ghouls like this guy are trying to argue that non-banks should stay unregulated because people love ‘em and innovation is important.

Again, I know nothing about Wealthfront but the “we’re not a bank” raises some concerns to me.