No idea if this is real

He also has a Xeet up about repeatedly lying on LinkedIn to build a newsletter following. Seems like he’s going to get himself investigated pretty quickly, which is probably fine if he’s not actually doing this stuff.

Although I’m not even sure if this particular scheme would be illegal. Probably not?

Does someone want to translate that into English?

Nevermind, I get it now. So he did all that to generate $8,350 in stock appreciation for himself?

Edit: I see it’s calls. So my math is off. But it seems like he didn’t exactly “get rich” off of this scheme unless I’m missing something.

No, he had call options rather than shares. So basically he bought the right to buy the shares up until a certain date at a certain price. So if he bought them with a strike price of say, $6, which would have been out of the money recently, each contract lets him buy 100 shares at that price which would be worth about $100 per contract. He probably would have paid like $10 to $20 per contract. So on $50K he could likely make $250K+ in profit.

Depends how you define rich. He’s 25 or 26 and likely has at least a few hundred grand now, not bad. Enough that if he invests it wisely he will be wealthy eventually.

If he created several thousand fraudulent accounts on a dating app he had a financial interest in using AI to trick thousands of people into spending thousands of dollars to create accounts so that he could manipulate the stock price…

I’m pretty sure he’s going to jail lol.

If he lied about doing that so that he could manipulate the stock price, he might also still be in trouble.

Outcome will be interesting whether he is right or wrong.

I think this is being reported poorly based on how filings for options work and it may be a much smaller position that’s really just a hedge, maybe around $10M of actual capital. He was running around $240M as of last quarter, so it would represent like 4% of his assets und and management. His filing is still mostly long.

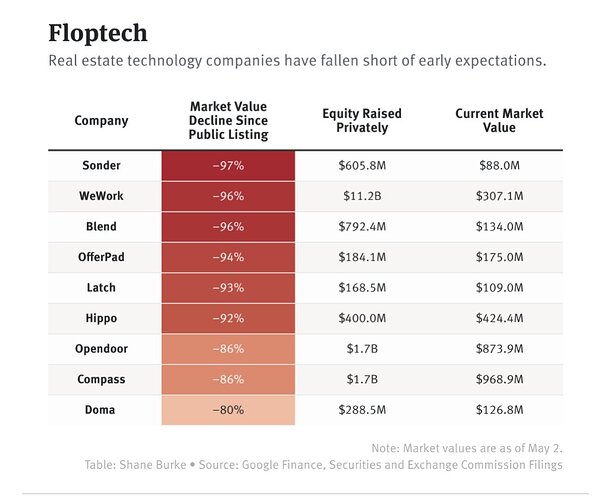

Seems like a good time to take a look at that list and see if one or two of them actually don’t suck.

calling wework a “technology company” is completely indefensible and an obvious grift

Unfortunately they all suck. I think almost all of those were SPAC mergers which were essentially VC/PE exit liquidity scams.

I don’t pay close attention, but I’ve noticed a lot of NOT STONKing lately across my holdings.

Any particular reason why?

Inflation still too high, job market still too strong, more rate increases likely.

They’re going to make housing, already unaffordable, even more scarce. Nobody is signing up for an 8% mortgage and builders can’t make money borrowing at those interest rates, so construction will just stop.

Risk free rate goes up → present value of future cash flows goes down

These two posts are somewhat contradictory, no? Can you elaborate?

Not really all that contradictory. The present value of future cash flows is valued based on how it performs vs the risk free rate of return. If the risk free rate of return goes up you have to perform better to get to equal.

People are pretty happy with a 3-4% growth rate when the interest rate is 0%. They’re a lot less impressed when it’s 5%.

If ERP is a constant and risk free rate goes up then equities would need to deliver a bigger stream of cash flows to have the same present day value. But none of those events actually makes it likely the enterprises will return more money to shareholders so their stock price should decline to match the lower present day value.