Oof! My portfolio went all positive today, after buying BOTZ after the AI buzz was gone and having it drop 8 or 9% it finally made it all back today. I’ll probably get rid of it soon.

I snapped up 4 $7.50 calls on it, which are already deep itm. Unfortunately, with all of the goings-on this week, I’ve hit my daytrade ceiling so I can’t do shit but watch helplessly as the price flails hither and thither and pray I can make it until tomorrow without it shooting back up again.

If it keeps dropping, however, at least I can buy back the covered call I sold and make a profit and then hopefully sell my remaining 100 shares for a profit as well. I’m just worried about after hours.

Also nasdaq going red today was certainly not part of my plans

Nuke these people into the sun yesterday

https://x.com/for_yield/status/1735362677701263871?s=46&t=XGja5BtSraUljl_WWUrIUg

![]()

There are going to be a lot of stories about record oil company profits in the next 2-3 decades… and that’s because when you generate gross sales and then don’t reinvest any of the money you generate higher profits than if you were using a large portion of the proceeds to do capital intensive ONG projects.

Obviously society should do everything it can to tax the shit out of these people (we won’t) but it’ll help everyone’s blood pressure to think through the accounting impact of what lowering carbon emissions would look like.

Couple of year end questions… FSI is up 30% most of it this last week. Anyone have thoughts on when to get out of it?

Also RMBS is up 20% this year and I’m torn between cashing out and putting more money in. Thoughts?

I vaguely remember this from econ classes in business school…

It’s always been a phenomenon in economics that price gouging from an economists’ perspective doesn’t happen in the rational response of merchants raising prices in response to a demand or supply shock (e.g. when a hurricane comes to town or something), but in that prices don’t normalize quickly when conditions return to normal. Merchants are slower to lower prices back down to the previous equilibrium competitive level than traditional supply / demand analysis would suggest. They basically can have some unspoken implied collusion with their competition knowing everyone is better off keeping the high prices rather than trying to gain market share.

I think to some extent this happened economy wide after covid and is still happening in some sectors where demand is less elastic and suppliers can get away with it (like housing).

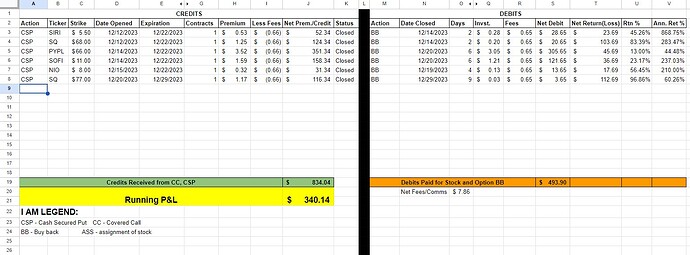

I started wheeling my roth IRA in December. Here are the results. A nice little profit for the first month, actually the best month it had all year despite how much S&P is up. It’s so insanely easy in green markets

Should be better assuming a similar market trajectory next month, as I’m moving out of Merrill to RH for the lower fees & 3% match.

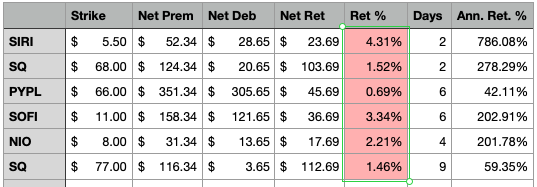

I feel like your return calculation is inflated since you’re using the premium as the basis. Unless I’m misunderstanding, selling cash-secured puts means you’re required to hold the cash needed in case you get assigned. For the first trade, you have $550 (100 x the strike price of $5.50) that’s actually at risk so that “capital at risk” should be the basis for the return calculation. Also I’m not sure how you’re doing your annualized calculation, but here’s what I came up with:

More importantly, I’m curious about how you’re generally making decisions about what to trade, what strikes to sell, and when to cover. Are you hoping to get assigned or are you always going to be buying back before expiration?

Disclaimer: Long time boglehead, generally against risky and time-consuming schemes including trading options, but perpetually curious.

Good questions.

You are correct about the return %, that is just a raw number that ignores the margin requirement. It’s simply how much of the premium I managed to keep, expressed as raw percentage.

As for annualized return, that number does take into account margin, so it is an expression of the return annualized, based on total capital at “risk,” though it’s arguable as to whether or not the capital is actually at “risk,” assuming you are selling csp’s on stocks you wouldn’t mind owning (which is what I always do with the wheel strategy, otherwise you can wind up bagholding something and losing way more than just what you spent on shares). As for the formula I used to calculate annualized return, I used:

(Returns divided by Capital at Risk) x (365 divided by Holding Period in days)

So for my spreadsheet the formula for the first csp is [=(T3/F3)*(365/O3); F3 is the strike price x 100 which is what I would pay for the shares if assigned, column F is hidden to help unclutter the output.

I suspect we got different results because you did not subtract the net premium received from your capital at risk number. That said, I’m not sure if my number is right because I used the net premium received (premium at time of sale minus what I paid to buy to close), whereas maybe the premium received at time of sale is the correct number? I’m not actually 100% sure now that I think about it. In any case, I feel like it’s correct to subtract premium received because that’s how our cost basis for assigned shares gets lowered, which is kind of the point. The cost of 100 shares @ the strike price is at risk. The premium I net I will keep regardless of whether or not I get assigned.

More importantly, I’m curious about how you’re generally making decisions about what to trade, what strikes to sell, and when to cover. Are you hoping to get assigned or are you always going to be buying back before expiration?

The first part is more complicated than the second, so I’ll answer the second first: I am almost always trading tickers that I would not mind owning if assigned, as alluded above. The only time I will deviate from this strategy is if I feel like IV is too juicy and the premiums are just too good to pass up, which does happen from time to time. That said, if you are running a proper wheel strategy, you generally only choose tickers that you would not mind owning. This is because there is always the chance that you will be assigned these shares, and the last thing you want is to be bagholding some AMC bullshit for six months while it circles the drain and you can’t unload it.

Not represented in my spreadsheet is what happens if you are assigned. It can be a blessing in disguise when this happens, actually, because you are often getting discounted shares, which is the best way to buy shares of any ticker, right? So like, take the last trade there, the $77 strike SQ csp. Obviously I am hoping when I initiate the transaction that the stock will go up (selling a put is bullish, of course) so I chose that strike based on where I thought the stock would be by expiration. But like, what happens if it doesn’t make it to 77? What if it’s 76 at expiration? That might sound shitty because we have to buy 100 shares @ $77, but that’s actually still good for us, because remember we received $116.34 when we sold the put. So we will actually be getting our shares for $75.8366 when we take premium into account, which is less than the $76 market value. We can then unload the shares for $76 and keep the difference + premium, or we can hold onto the shares and hope they go up. Or we can sell covered calls on them.

Covered calls are the other half of the wheel strategy. Once you get assigned. you can then sell calls against your shares, at a strike price which you would not mind selling them at and, again, pocket the premium on the sold option (this time a call rather than a put). So if I had been assigned shares on that SQ trade, for example, I could sell a call against the shares for like $81 with an expiration a month out. If the shares get called away at expiration, fuck it, I only paid $75.8366 for them, I’ll take 81. (note that you get royally screwed if it rockets way past $81…but you’re still not losing money.)

TL;dr selling puts is at the very least a nice way to lower the cost basis on a stock you would like to buy

As for when to cover, that depends on your risk tolerance. Some people close positions at 20% profit, every time, full stop. You will make less doing that, but you will also win more, on average. That depends on the person.

(And boglehead is a fine approach to investing overall, especially wrt retirement accounts. I just want to get ahead because I waited way too long to start saving for retirement so I’m way behind the curve.)

If you have no idea at all about options trading, set aside the time to watch this video. This guy breaks it down and covers all the bases:

Oh one more thing I forgot to address: I always close the option (“Buy to Close”) on or (usually) before expiration. The reason is, even though I can’t trade AH, trade still happens, and based on some bullshit freak ass bad news your ticker can gap down dramatically after hours (go look at Adobe’s stock before and after their after-hour earnings report last). Meanwhile, your option doesn’t technically “expire” until 12:59, so you can end the day thinking you are way up and then the old in-out performed on your AH as Alex described in ‘A Clockwork Orange.’ By closing before the bell you eliminate the chance of that happening.

How does your options strategy help you get ahead?

Well, when it works, it can beat buy and hold depending on the market and security. I also supplement with long calls/LEAPS/puts when I like a stock. Depending on when you sell or roll, it can also lead to higher returns than just buying and holding the security. Plus the returns are tax exempt in the IRA which is nice. hat’s the thing, though…when it doesn’t work, it doesn’t. (I’m lucky that my account is transferring this week as it’s been shit, for example. That SQ csp would have left me bagholding right now if expiration had been this friday instead of last.) It just depends on risk tolerance.

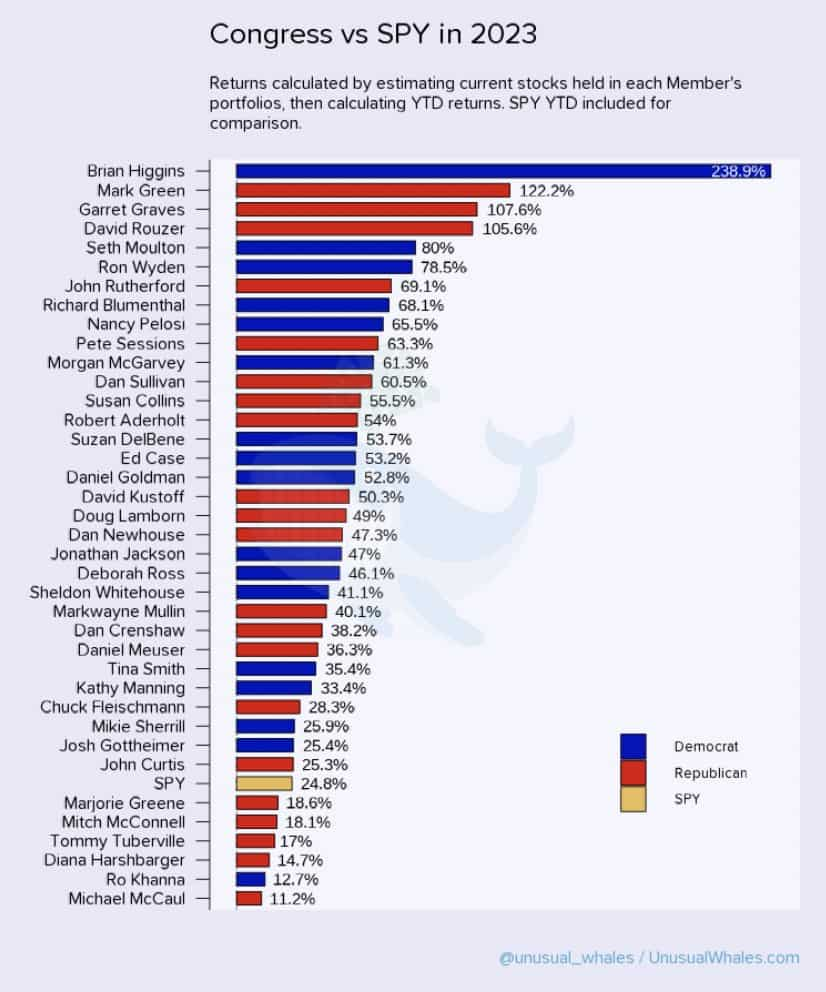

Buy Brian Higgins index obviously

I know it’s cliche, but “when it works” is doing a fuckton of work here.

But I guess we ultimately end up at the same place.

So only 32 out of 535 members of Congress beat the S&P?

… then again, let’s run that again for their spouses/parents/kids/etc.

There’s an important question which is: what is your expected return on the puts you are selling? You’re basically just making a bet that based on the return distribution of the underlying stock during the holding period, that your counterparty is paying more than fair value for the premium. It’s a zero-sum (actually negative) game, and someone has the worst of it. In order to believe that’s not you then you either a) Believe that certain types of puts are systematically overpriced or, b) Have a way of predicting future share movement that is sharper than the market. The fact that you are holding the underlying cash to settle the trade, or you “don’t mind owning the stock” is irrelevant to whether the underlying options bet is plus or minus EV.

I totally get using leverage as a way to juice returns, but I don’t believe you are padding returns at all with any short term options trading system. You are just creating a really complex returns distribution based on stock price movement over a short period of time that will generate a positive outcome most of the time, and then a negative outcome that will swallow up the gains.

I have a couple of investing rules that I very rarely break. No options and no shorting anything… and that’s coming from someone who ran hotter than the sun with options when he first started investing.

I agree we should check the spouses and kids. At the same time we should also acknowledge that inside information is actually nowhere near as OP as people think it is because the stock market is nowhere near rational. How many times in the last couple of years have we seen events where if we had known what was going to happen in advance we would have lost a fuck ton?

“With enough insider information and a million dollars you can go broke in a year.” – Warren Buffett who isn’t really wrong about anything related to investing. Seriously there is a GOAT and it isn’t particularly close lol.