VTSAX and chill baby

LOL hedge funds

The average gain for hedge funds in the year through November was 4.35%, according to a fund-weighted index compiled by research firm HFR. The S&P 500 rose 20.8% including dividends in the year through November.

Compared to the cybertruck it looks amazing.

My 2 shares are hoping you’re right!

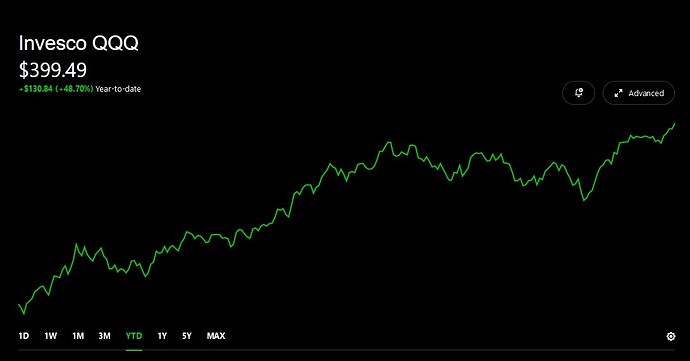

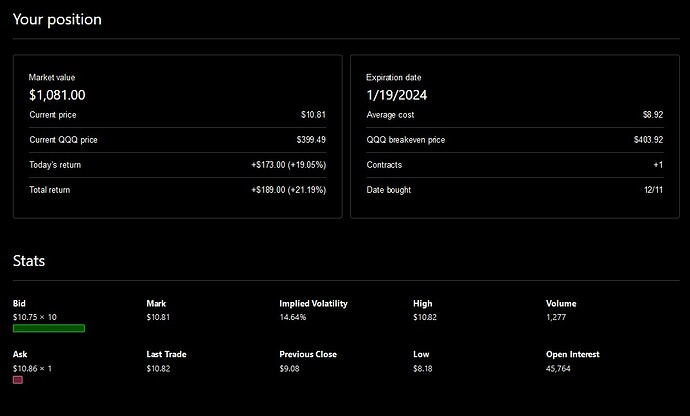

FYI there’s a ticker called QQQM you can buy instead, it follows QQQ exactly, only it has the advantage of being way cheaper, ~$165 / share v. ~$400 / share for QQQ as of this writing. It also has a lower net expense ratio (.15%) than QQQ (.20%).

It won’t matter much if you’re DCAing and buying fractionals, but if your broker only sells full shares it can make a huge difference.

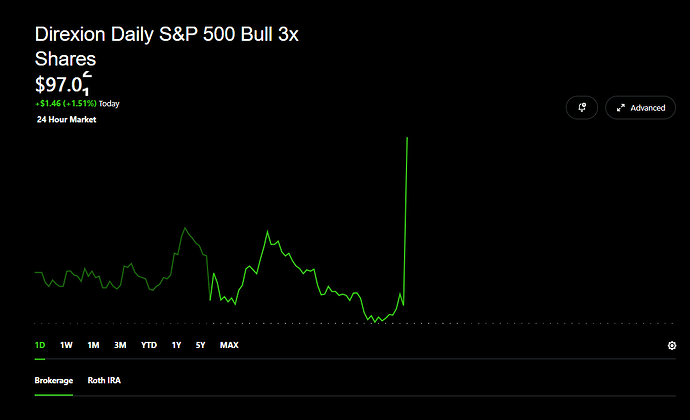

Powell did not, in fact, wreck it. Interest rates staying put, market sorosing

LOL @ this SPXL graph after Powell’s announcement

I hope nobody is surprised when a bunch of projects from the infrastructure bill break ground in April and run hard through the election. As annoyed as I am at Biden in general the man’s political timing is truly one of his 5 star tools as a politician.

Combine massive construction projects with interest rate cuts and 2024 might actually suck a lot less than 2023 did. Am I viewing all of this solely through the eyes of a trucking industry insider? Yes absolutely obviously duh. I do not care at this point I’m off 50% vs 2022 since November 1st lol.

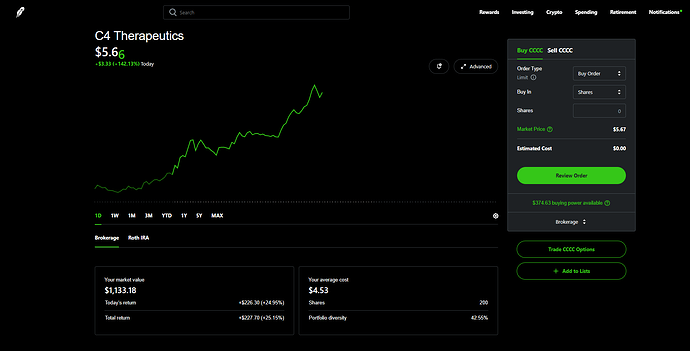

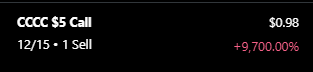

I found another one u guys. It’s a biotech company partnering with Merck for some new drug or some such.

I got in for the first 10 shares (because I was scared) @ 2.20, yesterday.

Today I log on and see it’s at 4.10 so screw it, 50 more. Got those @ 4.13. Then another 40 @ 4.18.

After I had 100, I very stupidly sold a covered call for a lousy $.40, so I’m almost certainly going to lose those shares, since I am up against the pattern day trader limit already for this week and can’t buy the covered call back. What I should have done is just buy calls myself. It is up 9,700% today

Anyway, I got another 100 shares @ 5.10 and here we are. BITF cooled off when buttcoin prices stalled earlier in the week so I dumped that and booked the gains.

Jerome Powell

Fox Business reporter: “Mr. Powell, how can we convince our viewers that this is bad news?”

All things being equal is it better to have more shares of a cheap stock or fewer shares of an expensive one?

I don’t think it really matters at all if you are just buying and holding. QQQ is more “liquid” than QQQM, which is why if you are for example an options trader you will see a lot more people trading QQQ options than QQQM, also QQQ has $204B in AUM while QQQM has like 17B. Returns will be the same since they both track the Nasdaq 100, they are just different-sized slices of the same type of pie. I haven’t looked but I assume their dividends are the same or pretty close, and not very much. Even the net expense ratio doesn’t matter all that much unless you have a whole lot invested ($150 v. $200 per $10,000 invested)

I went with QQQM because I was with Merrill and they don’t sell fractional shares, so it allowed me to buy more shares at a time in my IRA without having to let cash sit idle until I had enough to afford QQQ, since I was putting a fixed $ amount into it weekly.

I also used to hold SPY, which is the preferred S&P 500 ETF for traders. It has a .09% expense ratio, which is really low. VOO is the same thing, but it’s a little cheaper, and is .03%. But then I found SPLG, which is around $55 a share, allowing many more purchases at a time, and an even lower .02% ratio, so I just buy and hold that one now.

ICYMI, the annual NASDAQ changes were announced

The following six companies will be added to the Index: CDW Corporation (Nasdaq: CDW), Coca-Cola Europacific Partners plc (Nasdaq: CCEP), DoorDash, Inc. (Nasdaq: DASH), MongoDB, Inc. (Nasdaq: MDB), Roper Technologies, Inc. (Nasdaq: ROP), and Splunk Inc. (Nasdaq: SPLK).

The Nasdaq-100 Index® is composed of 100 of the largest non-financial companies listed on The Nasdaq Stock Market® and dates to January 1985 when it was launched along with the Nasdaq Financial-100 Index®, which is comprised of 100 of the largest financial stocks on Nasdaq®. These indexes act as benchmarks for financial products such as options, futures, and funds. The Nasdaq-100® is reconstituted each year in December, timed to coincide with the quadruple witch expiration Friday of the quarter.

The Nasdaq-100 Index® is the basis of the Invesco QQQ Trust (Nasdaq: QQQ) which aims to provide investment results that, before expenses, correspond with the Nasdaq-100 Index® performance. In addition, options, futures and structured products based on the Nasdaq-100 Index® and the Invesco QQQ Trust trade on various exchanges.

As a result of the reconstitution, the following six companies will be removed from the Index: Align Technology, Inc. (Nasdaq: ALGN), eBay Inc. (Nasdaq: EBAY), Enphase Energy, Inc. (Nasdaq: ENPH), JD.com, Inc. (Nasdaq: JD), Lucid Group, Inc. (Nasdaq: LCID), and Zoom Video Communications, Inc. (Nasdaq: ZM).

Maybe if @spidercrab is around he can give us an analysis of BRK.A vs BRK.B. But I guess in that case they are not truly equal.

They’re pretty equal. You can convert A’s into a set number of B’s but not vice versa. Generally speaking the A’s have been trading extremely close to the converted into B’s value every time I’ve checked. I would guess that every time it goes outside a certain range a half a dozen algo traders instantly convert A’s into B’s, sell the B’s, and rebuy an A.

It feels better having 100 shares that go up 3% than 2 shares that go up 3% but you’ve still only gained 3%…

CCCC is up to 7.84 fml

welp lol