I’m guessing they just folded it into their bigger uber-branded delivery product (the uber eats drivers will basically do postmates-esque delivery of stuff like toothpaste etc, seems like drizly is just a subset of that

ABC said it was likely to bring the functionality into Uber Eats basic application instead of having two, and that Drinkly had been dinged for security problems in the past.

Here’s my off topic question - how did “amazon for pets” (chewy) take off/stay in business at all?

also this worked fine for my chrome archive extension (gcaimhkfmliahedmeklebabdgagipbia) https://archive.ph/iyAn8

Ryan Cohen is a generational talent when it comes to being a grifter. Look at what he did with BBBY PnD.

Amazon feels so grifty and scammy all the time, maybe people don’t trust their pets’ health with it? ![]() I’ll ask my wife, she gets our pet stuff on Chewy.

I’ll ask my wife, she gets our pet stuff on Chewy.

yeah I would sort of assume that there’s a 15-20% chance that any dog food I buy on amazon will be counterfeit lead/asbestos mixture dropshipped from china

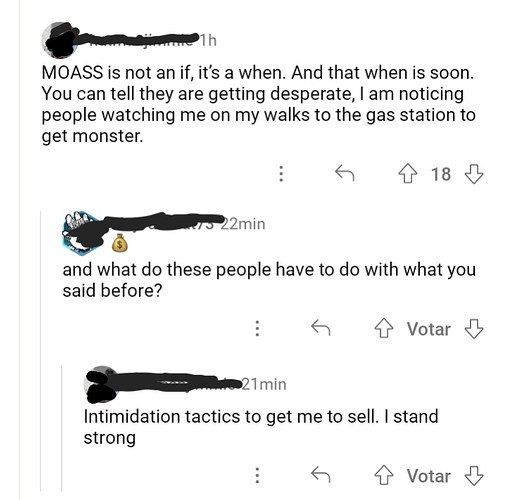

What is MOASS?

Mother of all short squeezes

Sorry, sometimes I forget that memestonk lingo isn’t household vernacular. MOASS is what d10 said. The author being gangstalked by (((them))) is either a GME or AMC ape.

GME cultists refer to the 2021 squeeze from $4 to $513 as the “sneeze” and believe it was nothing compared to the MOASS that awaits.

DWAC closed +88% today, nice! Up almost 200% since Iowa, meanwhile bad fundamental news on a spac whose fundamentals were already atrocious.

Nvidia’s stock value almost doubled in 24 hours?

Not quite that fast, but it was in the 400’s still a couple weeks ago

Also bought lolsla puts because Q4 earnings tanked as expected.

Dumbfuck Elon partially blamed “interest rates” which haven’t changed since Q3

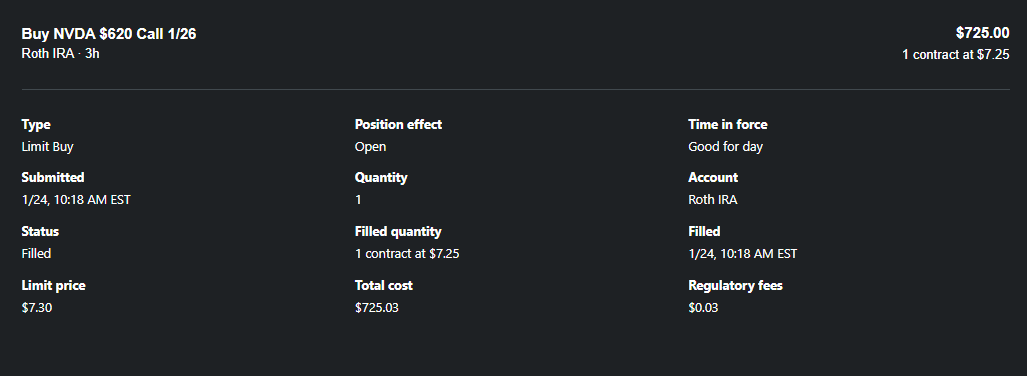

NVDA opened today at $603 and reached a mid-day high of about $628.

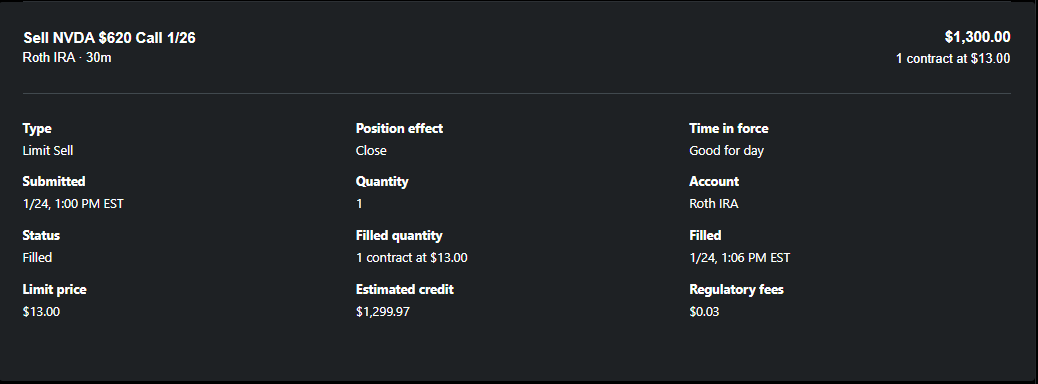

During this time, Namath bought a stock option for $730 and sold it 3hours later for $1300.

The specific option represents the right to buy shares of NVDA at $620, so it should make sense that the option becomes a lot more valuable as the underlying stock price actually rises above 620.

Because of the leverage involved, option prices can move quickly when the underlying stock moves in your direction.

On the other hand, risk is also heightened since in this case the option would expire worthless on Friday if the stock price had stayed below 620.

How many shares at $620 was he buying the right to purchase for $730?

Think they always for 100

One options contract = 100 shares.

(I misread; to clarify, the buy order had a limit price of 7.30 but was filled at 7.25 = $725 total.

Options pricing is fucky and depends a lot on how volatile the underlying stock is in general. For example, Coke (KO) has a very stable price so when it dropped 3 - 4% in October, short term options went up over 20x.