correct

FU Elon slappies

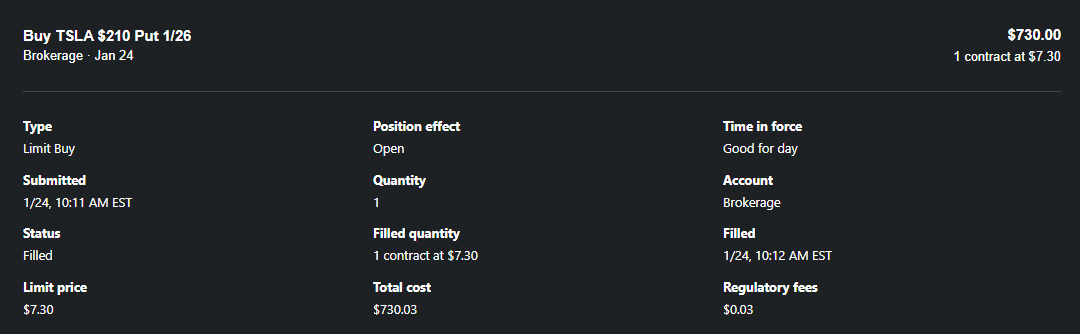

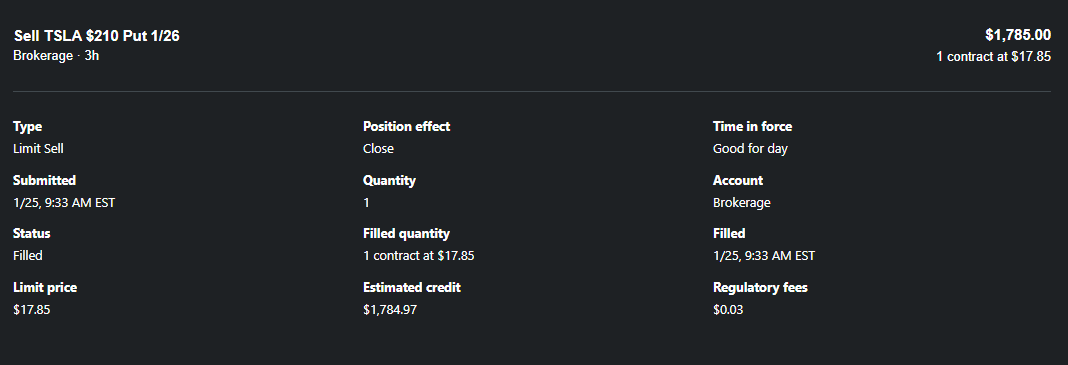

Because I am a paper-handed idiot, I got spooked when the price spiked briefly back up to $192 not long after opening. I assumed the Elnoturds would be all ‘omgz buying opportunity’ and drive it back up, so I panic sold. They say you should never feel bad about taking profits, but now the put that I sold for $1,785 is worth $2,785 ![]()

![]()

![]()

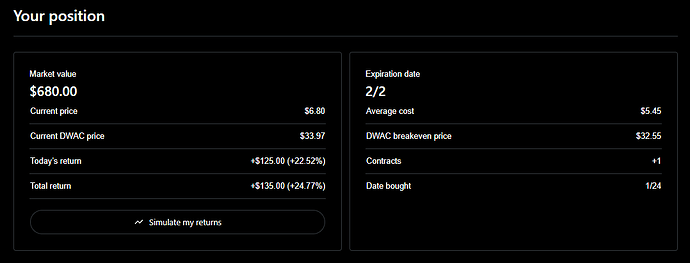

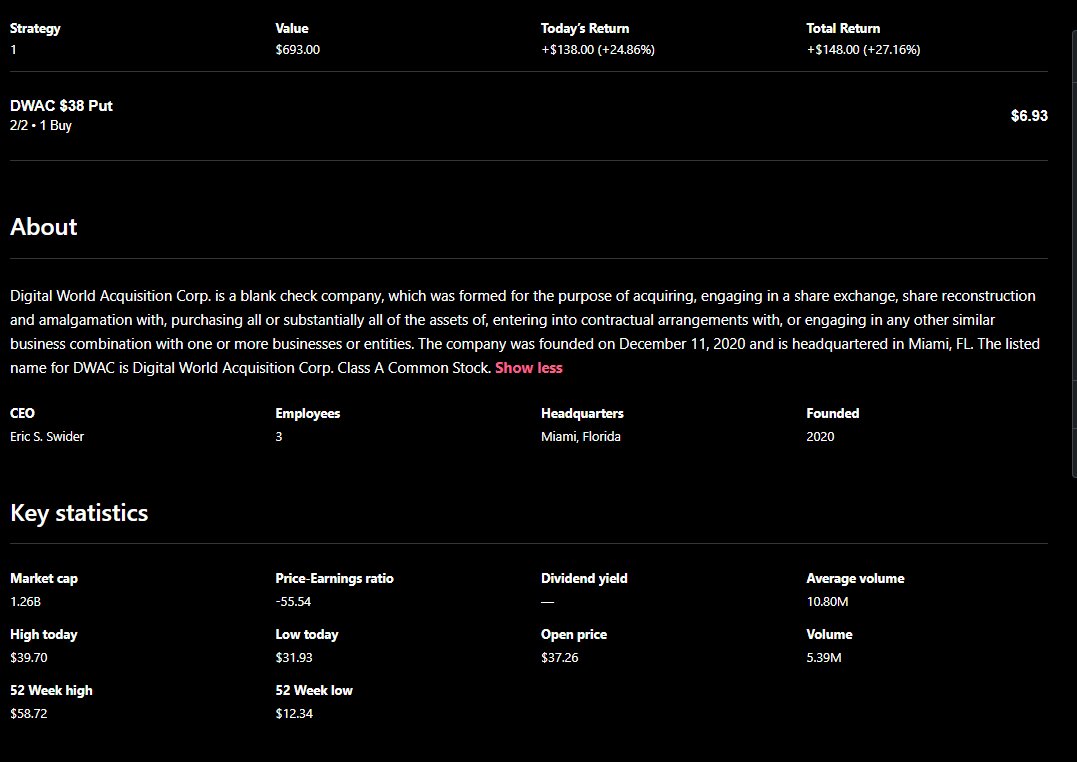

Next bear play is puts on that dumshit Trump stonk DWAC.

It mooned recently from about $17.50, where it’s been sitting for like a year after the yuge drop following IPO, all the way up to almost $51 after Trump knocked Desantis out in Iowa. Since then, it’s been steadily sliding back down toward the earth’s core, where it belongs. I have no idea what DWAC does, or how it makes money. Actually all I know is that it doesn’t make money, like, at all, and there is no reason for it to be even $17.50, never mind $51.

It went down after the NH primary (unlike the Iowa caucuses move) so I think people are finally realizing that, hey, this is an actual piece of shit and maybe I should dump it before it makes me poor?

Anyway, puts on DWAC

Don’t underestimate the will of these morans to keep the stonk up. It held up for a long time, and idiots will pump it if (when) he wins the nomination.

I’m still in shambles that I missed the initial run up when the merger was announced. I saw it at $13 in pre-market and was like fuck it, going back to bed because SPACs are dead… then it spiked to $100+.

Yeah I’m being more than a little hyperbolic above. I have seen it before with shit like PLTR and AMC and GME and fucking BBBY, where absolute dumbasses will diamond hand their shit long, long after they should have dumped it. Hell, you could STILL find people on reddit who will swear that BBBY isn’t really bankrupt, there’s some kind of sekret stuff going on, and the stock is going to make a comeback…even after it was delisted.

I bought $38 strike for Feb 2 expiry, and my breakeven is $32.55. It’s already green, but if it looks like the stock price is about to melt up again I’ll probably take whatever profit is there sometime tomorrow. I’d rather not hold it over the weekend and just let theta chip away at the gains.

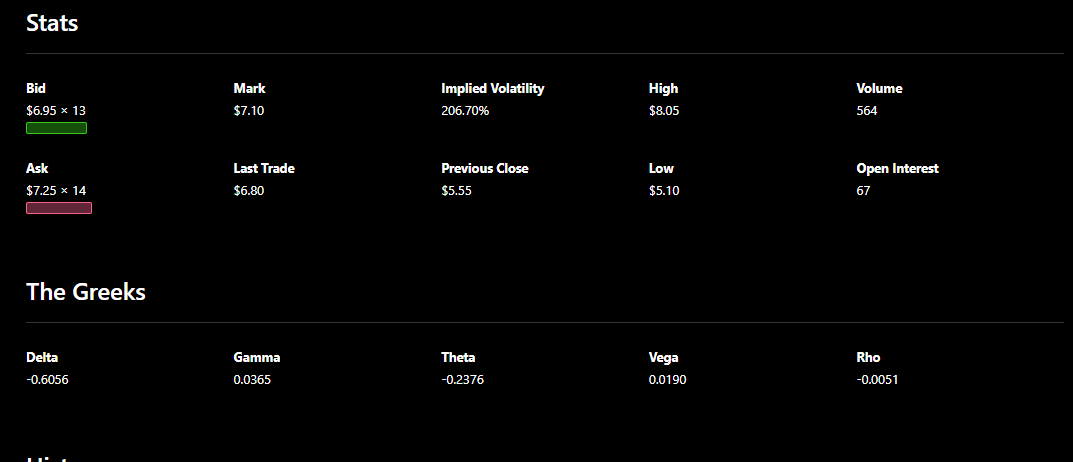

eta shit theta is already pushing .25, so I’ll probably get out today

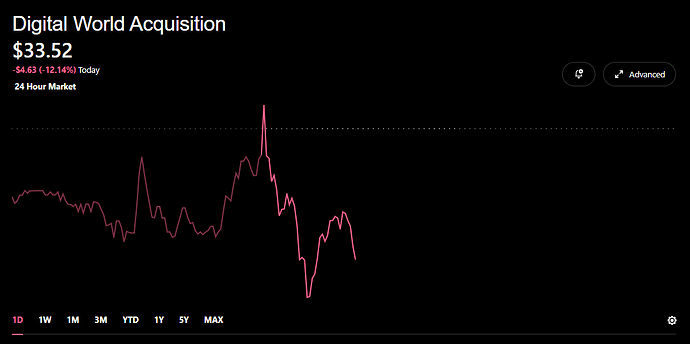

I should have sold at the bottom of that V there, but as you can see it’s trending downward again. I’m basically betting that the decrease will beat theta by holding longer, and that’s usually a bad bet:

Been there plenty of times when closing shorts, because I know exactly what you mean about the idiot bounces in those kinds of stocks (for instance TSLA after Q3 bouncing all the way back to what it dropped from). I’m sure the temptation to paper-hand is even bigger with options. With my short, thanks to the <1% fee rate, I just get to just chill for the long haul.

That said, obligatory:

lol we watched ‘Dumb Money’ last night and I think they showed this meme, along with a bunch of other classics from that era (pretty good movie btw)

Yeah DWAC/TMTG are fucked long-term. Either the merger gets cancelled and longs get left with $10.30, or the merger happens and they quickly get diluted to oblivion. I’m rooting for the merger of course.

I dumped my put for $130 profit. It’s chopping around $34 and looks a little range bound today and I figure it’s better to go ahead and take profits and not let theta keep fucking me. I’ll probably buy more puts tomorrow though.

DWAC is a shell company that’s reverse merging with TMTG. The employee is indicative of that team - not TMTG.

That said, TMTG is still a scam.

Once it merges, removes the NAV floor and the sponsor and PIPE shares start to unlock its going to absolutely die. I love watching SPACs drop 80% in 2 days.

NVDA has cratered back to prices not seen since…yesterday

Yeah they have some scammy 24 hour market thing for certain tickers…

Is it just Robinhooders trading with each other?

I don’t think so. Apparently they use Blue Ocean ATS. It’s probably MMs and HFTs just exploiting a bigger spread due to lower liquidity.

IBKR has overnight trading too, also through Blue Ocean (not sure if that’s the only venue).

Doing my ~quarterly review of my portfolio and digging into the macroeconomic conditions for the first time in a minute. Can someone explain to me why it’s just assumed we’re automatically going to have several rate cuts this year?

Inflation is still running well above the 2% target, the rate of inflation increased again the last couple of months, the stock market is at all time highs, and unemployment remains low. Other than commercial real estate/wealthy people want lower rates, is there a reason to cut?

Powell was pretty clear last week that they’re not going to cut the rate unless/until hitting that 2% target is assured, which it is not yet. So while they think rate cuts are likely, I’m sitting here looking at the inflation rate ticking back up saying, “I dunno, man, could go either way here.”