What appellate court decision is he talking about?

Lol looks his attorney was about to yell at him when he was talking about people needing to fight. Lot of Botox for the poker face probably a requirement for representing him

The highly political, Trump Hating Judge just stated that expert testimony is not evidence. Well, that means that every trial in American history has to be thrown out and started all over again!

( truth (lol) | raw text )

I think this one:

but like, in a ![]() turn of events, there’s no Ws for Trump in this ruling at all

turn of events, there’s no Ws for Trump in this ruling at all

There’s also this from a few months ago:

They tossed claims against Ivanka and restricted the scope of the suit to events after 2014 or 2016 depending on context (it was previously filed for stuff going back to 2011) because of statue of limitations.

I have never understood Trump’s hair, but I really don’t understand what’s going on here:

I hope somebody can get to the bottom of this.

I hope someone updates the IRS with the valuation of Mar-a-lago at 1.5 billion instead 18 million…

I don’t know about Florida, but in California (and I would assume everywhere), the value upon which your property tax is based is NOT the market value of your property. Maybe it should be, but it isn’t.

Anything that makes Trump apoplectic like this is A-OK with me, but I hope this isn’t where the DA is hanging their hat.

My understanding is that the 18 million came out of a suit Trump filed when Mar a Lago was evaluated at 26 million for tax purposes and Trump said that was too high. There shouldn’t be a 50 to 100 times difference between what a property sells for and what it is taxed at, that seems stupid.

Yeah, you have to factor in the equalization rate / residential assessment ratio. Some jurisdictions have ridiculous equalization rates (like less than 10 percent), such that a property actually worth 360 million could be assessed at 18 million (assuming 5 percent equalization rate). However, I’ve never heard of a jurisdiction that has an equalization rate of less than 1 percent so I don’t think Trump has a winning argument here.

In CA, that’s because of proposition 13, right?

The proposition decreased property taxes by assessing values at their 1976 value and restricted annual increases of assessed value to an inflation factor, not to exceed 2% per year. It prohibits reassessment of a new base year value except in cases of (a) change in ownership, or (b) completion of new construction.

As a new-ish homeowner, I’m paying property taxes on pretty close to the market value of my home (I guess excluding the COVID pump in home valuations).

I was coming to post something similar. I think when a property is sold the tax basis can reset to the sale value. Then it should only go up 1%ish a year after.

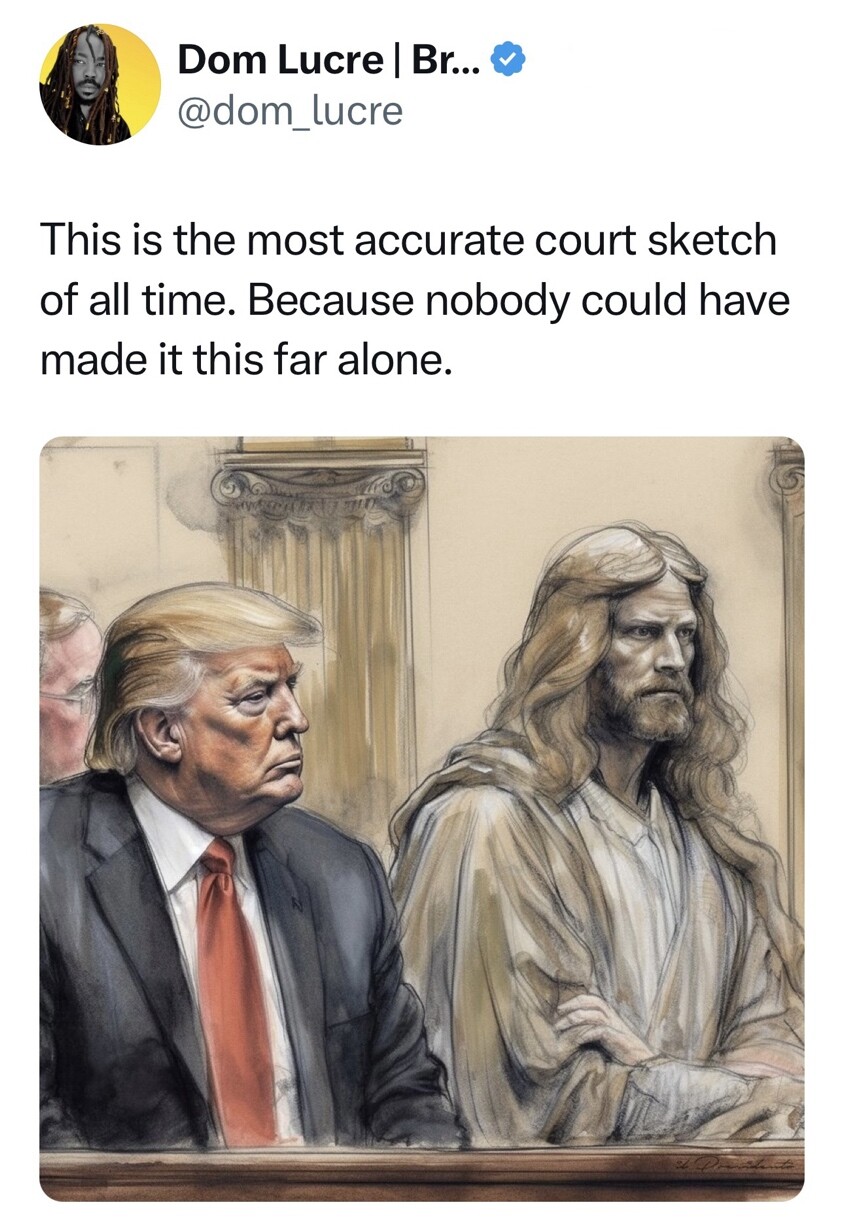

“Thank you for your help, Charleton Jesuston.”

Wow, Jesus on trial for a second time.

Gonna be 0-2 against rigged and crooked judges

Little late there Johnny

https://x.com/accountablegop/status/1708958513282654361?s=46&t=XGja5BtSraUljl_WWUrIUg