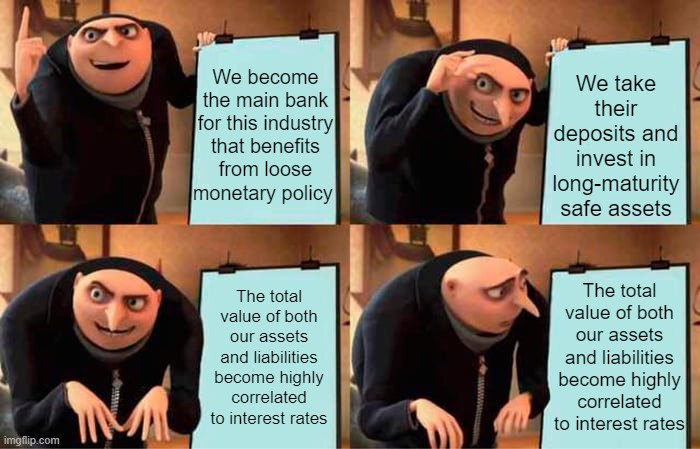

Do these people want big govt interfering with their money or not?

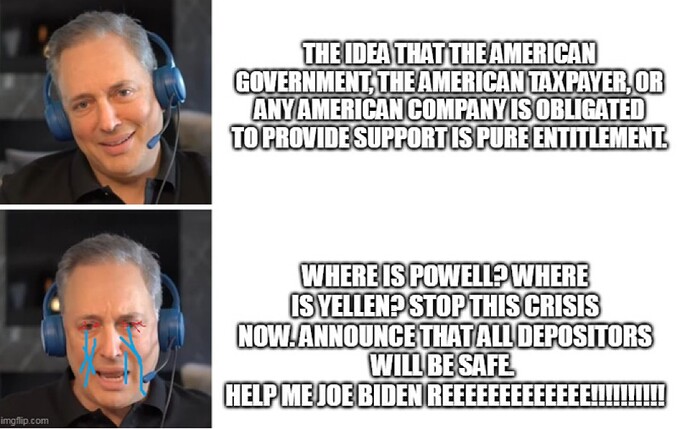

I saw a tweet today saying “like no atheists in a foxhole, there’s no libertarians in a bank run” quoting some VC demanding the feds make SVB whole

Levine is the absolute best.

Oh. Fuck.

Yeah but Levine basically said the same thing, so Cramer is probably not wrong this time. Levine said companies may move their money to JP Morgan.

Conbase ngmi?

So what I’m reading is Giannis knows how to manage risk better than a bunch of VCs who want a bailout now?

Yeah, that doesn’t seem so strange, isn’t 250k the FDIC limit? I mean, he probably needs a better accountant, but still there are enough vowels in his name to indicate he doesn’t trust banks very much.

Cramer is so fucking bad at this.

We’re approaching Trump level “there’s always a tweet” territory here:

9 of the 10 stocks are down since that list. Why didn’t we just short the whole fucking list?

I seriously think Jim Cramer’s job is to help facilitate the passing of the bag from the hedge funds and investment banks to the retail investors so that the suckers are holding the bags when the shit hits the fan. Like these Wall Street bros go, “Hey Jim, we’re in a real mess over here. SVB is going to go under. We’re trying to exit our position without totally collapsing the stock. Can you pump it up for those retail shmucks? Yup, we’ll give you a stick.”

I’m not even sure this counts as a conspiracy theory because it’s too plausible.

“While acknowledging that the precise math is not immediately clear, Phillips estimated that the uninsured depositors could face losses of between 10 and 15 percent from the returns on the sales of these assets, which would be difficult for them but not catastrophic for the economy.“

https://www.washingtonpost.com/us-policy/2023/03/11/silicon-valley-bank-bailout-washington/

Um, if we get into Monday with the state of play being that SVB is just going to wind down and uninsured depositors are probably going to lose 10 to 15% of their deposits then hide your children, hide your wife, financial crisis here we come and probably not reversible this time given the state of our politics.

“Not catastrophic for the economy”…. hard to tell if our regulators are that stupid or just powerless and putting their best spin out there.

Confirmed Powell is not that stupid:

So we are just knowingly walking into the abyss?

I mean he’s been trying to trigger a recession for a while now…

The dumbest thing we did in 2008 was the bailouts. This is literally the exact same scenario as the crypto failures that many of you, rightfully so, laughed at the idea of bailing out. But because it’s in $ instead of a cryptocurrency we should bail out wealthy people who were knowingly taking on added risk?

If you want to argue that the FDIC should insure deposits of any amount, go ahead and argue that and get the FDIC rules changed to do so. That comes with a higher insurance assessment that all of the banks will have to pay now. As it is, they knew these deposits were uninsured, didn’t seek out other options to insure the amount over $250k or protect their deposits in any other manner, and put this money into a bank that was higher risk because they were seeking a higher return on their cash that was only possible because of the higher risk involved.

We cannot keep creating these scenarios for the wealthy where they take on added risk and either get richer or they get bailed out at the expense of the average person.

These are the same people always telling the less advantaged people that they need to take personal responsibility and fight for zero regulations, but when those lack of regulations hurt them they cry for a bailout. The same people who likely got millions in PPP loans forgiven while fighting against student loan forgiveness. Fuck them.