Oh, are you at a private company? I didn’t realize withholding illiquid shares for taxes was an option.

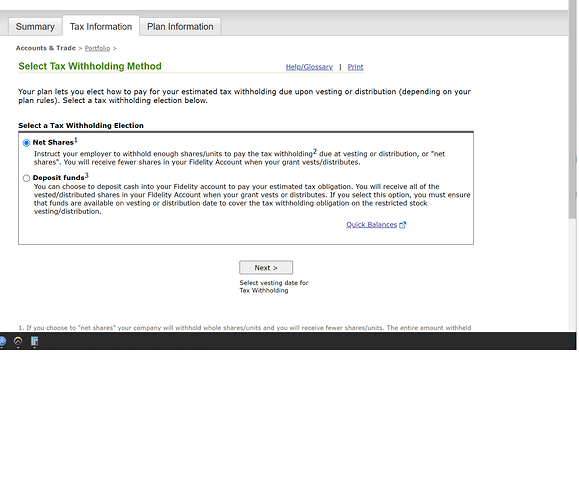

Hmm no, public, but this is how it has always worked. 148 shares vest for me on monday and I’ll only get like 100 for reals.

I mean, yeah, at a public company that’s easy enough (I have the same process). There’s no problem with getting stock and having to sell a third of it to cover taxes immediately.

The problem is when you’re at a private company and, as far as I know, when you get an RSU vest you

- immediately incur a taxable gain on the $ value of the shares, but

- you can’t sell the shares, so you have to pay the taxes out of pocket

there’s no way this can be the case. If so I owe the irs thousands in imaginary money I had exactly zero chance of ever getting.

RSUs are different than options. RSUs are actual shares, not options to buy shares.

when an RSU vests, you have obtained an asset, and that’s a taxable event.

when an option vests, you now just have an option to acquire an asset. Even though an option to buy something is (in some cases) worth something itself, it’s not taxable until you exercise that option.

in other fun job-related news, silicon valley bank went kaput today, and of course that just happens to be where my company has all its cash.

looks like the rumor is that JPMC is going to buy everything for like $10, maybe as soon as tonight, but I already have bets with cow-orkers that there’s going to be a hiccup with payroll next week (our comptroller says “too soon to tell” which I am taking to mean “we’re fucked”).

the good news is that we’re basically cashflow neutral, maybe a little positive at this point but if cash on hand is literally $250k we’re turbofucked

…and on top of that, options can also present rough tax situations, in that you might acquire tax-free (for now) options while working at a company, but when you leave that company you don’t take the options with you, you gotta decide then if you want to exercise them or not.

So if you exercise them, like pvn said, that’s a taxable event for the difference of the share value vs. your option strike price, even though you’re still (at that point) getting shares you can’t sell.

When I left my last company I had 90 days to decide whether to exercise my options or not, and I wasn’t sure what I wanted to do. Then the company went under before the time limit expired, so that made the decision easy, but I very likely might have lit a small amount of money on fire to exercise them if that hadn’t happened.

Another approach for RSUs is double-trigger vesting - I think the Stripe article references this, but the idea is that “vesting” has two triggers, one is the normal vesting schedule but the second is that the company has some kind of liquidity event (selling, going public) that allows you to actually sell the shares. So, then the shares don’t technically vest until you’re able to sell them, and you avoid the taxable event. But I think this also runs into the problem of, when you leave the company, you no longer get the double-trigger benefit and you need to decide right then if you want to take your vested shares (and the associated tax bill) or not.

This post is relevant for SVB:

The likelihood that uninsured deposits there get torched seems exceptionally low. There might be short-term hiccups but you guys will probably be fine.

yeah if JPMC does ride in everything is probably fine other than maybe a delay in the next paycheck

In related fun news I sold last years rsus in April for $245/share and now the stock is squints $155. Great.

you’d generally only know about it if you work in a sre/devops type of role, but you almost certainly know of it if you do. it’s really critical to a lot of infrastructure. My mind is still blown, lol

Yeah, my company’s stock is down a similar amount from its highs. I can’t be too mad, the grant I received upon starting in 2019 did gangbusters.

My original (big) grant was when it was at $70 so its been quite the ride. Gonna sit on these shares for a while I think if not forever/until it gets back to 200+. I don’t need the cash and I don’t see why this company can’t recover. Right? ![]()

ehh the way I’ve always looked at this is

- for as long as you are working at that company you have significant exposure to their stock price via future vests, and

- by keeping their stock you receive you are actively making an investment decision to invest in that company over the broader market, even if it doesn’t feel that way because it’s the passive action

I sell my RSUs immediately on vest and redirect it into a broad market ETF.

yeah just feel like gambling a bit.

My boss hates me and didn’t give me a RSU grant last year, and my big grant expires on Monday. My annual review is next week also and I expect to get shit on again. I’m gonna say “yeah hey so next year I’m going to make about $20k less, how would you feel in my situation?”. Reason number 67 I need a new job but that seems really rough right now.

depends on what you do but i think there are plenty of signs the tech job market is still insanely hot, despite all the layoffs I believe for January the tech market actually gained jobs, and unemployment across-the-board is a shocking 1.5% for tech

my inbox Recruiter spam has barely slowed at all

my last job my boss despised me, i’m never gonna willingly be in that situation ever again

Yeah disagree mostly and the CS subreddits are pretty dire about it. I’m sure it will be fine in 6-24 months but its ugly right now. IDK I’ll think about it I guess after my review.

My RSUs are halved in 2023 and gone in 2025 I mean what do they think will happen I’m just gonna eat that? Of course I wasn’t given RSUs when I was hired, in my first review, and they were worth ~1/4 of what I’ve got for them when I sold them. I know this is 1st world problems but still, right? I’m not really sure. I brought this up last year when I didn’t get RSUs and my shitty boss was like "oh they’re just a bonus, not to be relied on ![]()

![]()

![]() " and I was thinking “the fuck they are” but didn’t speak up yeah.

" and I was thinking “the fuck they are” but didn’t speak up yeah.

welp anyone hiring lol. Gonna go find a barber who dies gray hair I guess… good thing I’m not a beard guy.

now that AI has gone mainstream and oh boy did it ever, I, as somewhat of a computer science person, have had an embarrassing lack of knowledge as to how LLM’s work in general. This article broke it down in close enough to layman’s terms for me and is a fantastic read.

I’m surprised at how much of this we basically don’t understand why it works. With llama weights being leaked, and dozens if not more open source ai projects already underway, this tech is here and here to stay in a big way. I’m going to try to train a LLM of my own to do some very specific programming tasks in kind of a niche area and see where it goes from there, but woo boy this shit’s gonna change the world, and I’m not sure in a better way.

Hopefully we can get one to explain how it works before the singularity…